Options wizard

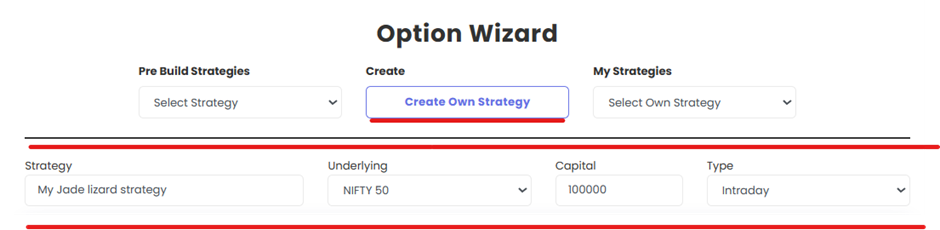

Before we begin, this is how options wizard of tradetron looks like. This page covers step by step guide on how to use options wizard effectively.

Options trading can be a rollercoaster for many traders, especially when they're crafting a strategy from scratch and executing the same strategy manually. Imagine executing 4 legs of your strategy manually into broker terminal that too without stop loss and target orders , and then continuously sitting in front of screen throughout market hours and waiting for exit signals.It often involves a cycle of making profits, feeling nervous, seeing their portfolio shrink, and hoping things will turn around. But there's a solution! Use Tradetron's Options Wizard for a smoother options trading experience where you can execute the entire options strategy with pre-defined target and stop loss orders into your broker terminal in just 2 minutes. It simplifies the process, making options trading easier and more profitable.

Tradetron’s options wizard offers flexibility and adaptability, catering to different market conditions and risk appetites.Strategies used by most of option traders are already a part of pre-defined options strategy list in wizard.All you need to do is select the strategy as per your market view and modify it as per your requirements and you options wizard algo is ready in just few minutes.

Option trading strategies come in various flavors, each tailored to different market conditions and trader objectives. Some of the Popular strategies which are already a part of tradetron’s option wizard list are:

- 1. Covered Call: Investors sell call options against stocks they already own, generating income and potentially offsetting losses in the stock's value.

- 2. Protective Put: This strategy involves buying put options to hedge against potential stock price declines, safeguarding your portfolio.

- 3. Straddle: Traders buy both a call and a put with the same strike price and expiration, aiming to profit from significant price movements in either direction.

- 4. Iron Condor: A neutral strategy where traders sell both a put and a call while also buying a put and a call with different strike prices, profiting from limited price swings.

- 5. Butterfly Spread: This strategy combines both call and put options to create a limited-risk, limited-reward position that profits from price stability.

- 6. Strangle: Similar to a straddle, but with different strike prices for the call and put. Traders use this strategy when they anticipate significant price volatility but aren't sure about the direction.

- 7. Collar: Combines covered calls and protective puts to limit potential losses while capping gains.

These strategies offer flexibility and risk management options for traders, allowing them to adapt to various market scenarios and trading goals.

Here is a step by step guide on how you can build your options wizard strategy in just 2 minutes -

Step 1-

On the basis of your bullish, bearish or sideways view on index you can execute your algo through options wizard.Upon login, once you click on options wizard you have two options either you can create you own set of logic and add legs or you can select a strategy from pre-defined list. For demo purpose I will make a strategy on options wizard. Click on “Create own strategy” > Give “Name “ to wizard strategy > Select “underlying” > Select Type as “Intraday” or “Positional”

For demo purpose I will constitute Jade lizard options strategy, The Jade lizard option is a custom strategy that constitutes a bear vertical call spread. An OTM PUT option is sold on top of vertical call spread to reduce the risks. It is a slightly bullish strategy.

In simple terms, this option strategy is constructed by buying a call option at one strike price, selling another call option at a lower strike price, then selling an OTM put option at a strike price lower than that of both call options. All the options sold or bought should belong to the same expiry date.

Step 2-

Go to Entry settings in options wizard and select the time you want to execute this options strategy. For demo purpose I want to execute my jade lizard option strategy at 920 .You have an option to select trading weekdays too.

Step 3-

Go to positions segment in options wizard and add the leg wise details of your strategy.Simple drag and drop option is available in tradetron’s option wizard where users can select details like CE or PE , strike price details like ITM,OTM ,ATM . Expiry details like current week , current month , next week ,next month everything is available.Once you add all the details of the legs you want to execute you can click on “ADD”button.

Step 4-

Tradetron provides various risk management tools in option wizard in order to protect losses OF options traders and become profitable in longer term.You can add leg wise target , stop loss and trailing stop-loss all under positions segment in options wizard.Once you click on Target or stop loss or TSL wizard provides you this two option.

A- Target/SL/TSL based on % Of entry price

B- Target/SL/TSL based on Points

You can select one of them and enter details accordingly

For demo purpose in my jade lizard options strategy I am adding Target/SL and TSL on the basis of points.

Step 5-

Last and final step is adding exit conditions in exit settings. Exit settings comprises of time based exit and overall MTM Profit and loss.Some advance features in tradetron’s option wizard exit settings are exit on the basis of strategy level Trailing stop-loss and exit on the basis of Exit on expiry day or After certain days of entry in case of positional options strategy.

In case of overall MTM profit and loss below are the 3 options available for traders

A- % of capital

B-Amount

C-None

Once you add Entry details , position details and exit details your option wizard strategy is ready to take trades in your broker account.All you need to do is click on “Save”Button at the bottom of wizards page and Congratulations your strategy is ready to deploy in your broker account

FAQs on Tradetron's Options Wizard:

Tradetron's Options Wizard is a feature that allows options traders to quickly create algorithmic options trading strategies in just 2 minutes. It simplifies the process of designing and executing options strategies.

The Options Wizard provides a user-friendly interface where traders can choose from a list of pre-defined options strategies such as straddles and spreads. They can then customize these strategies by adjusting strikes, adding target prices, stop-loss orders, and trailing stop-loss orders.

Yes, you can customize the pre-defined strategies by changing the strikes and other details of the options legs to suit your trading preferences.

The Options Wizard allows you to add target prices, stop-loss orders, and trailing stop-loss orders to your strategies.Options wizard also allows you to add overall MTM profit and loss. This helps you manage and mitigate risks associated with options trading.

You can execute the options strategies directly through your brokerage account. Tradetron facilitates the seamless execution of the strategies you create using the Options Wizard.

While prior experience can be helpful, the Options Wizard is designed to be user-friendly and accessible to both beginners and experienced traders. It provides a simplified way to engage in algorithmic options trading.

Tradetron may have its own pricing structure, so it's advisable to check tradetron pricing page - https://tradetron.tech/user/pricing for specific pricing details related to using the Options Wizard.

Yes , you can now backtest option wizard strategies too.

You can enhance your Option Wizard strategy with indicator-based conditions using the Strategy Builder. Simply access the Strategy Builder and add the desired indicators to your strategy. Keep in mind that once you make these updates, your strategy won't reopen in the Wizard, unless you're adjusting advanced or marketplace settings.