Options trading provides traders with powerful strategies to navigate uncertain markets. One such approach is the strangle option strategy. Popular among traders who expect significant price movements but are unsure about the direction, a strangle can be an effective way to benefit from volatility.

This guide will help you understand how the strangle works, when it is typically used, and how you can simplify and automate it using platforms like Tradetron.

What is a Strangle Option Strategy?

A strangle is an options strategy that involves purchasing (or selling) both a call option and a put option on the same underlying asset, with the same expiration date but different strike prices. Typically:

- The call option is bought at a strike price above the current market price.

- The put option is bought at a strike price below the current market price.

This strategy is designed to capitalize on significant price movements, regardless of direction. If the underlying asset experiences a sharp increase or decline, the gains from one leg of the trade can offset the cost of both options and deliver a profit.

When to Use a Strangle Strategy

The strangle option strategy is best suited for scenarios where:

- High volatility is expected: Events like earnings announcements, economic data releases, or political developments often cause substantial price movements.

- Uncertainty about direction: The trader believes that a large move is imminent but is unsure whether it will be upward or downward.

- Lower upfront cost: Compared to a straddle (where both options have the same strike price), a strangle is generally cheaper because the options are purchased out-of-the-money.

Risks and Rewards of a Strangle

Potential Profit

- The maximum profit is theoretically unlimited on the upside if the asset price rises sharply, or substantial on the downside if it falls dramatically.

- Profit kicks in once the asset’s price moves far enough beyond either strike price to cover the cost of both premiums.

Maximum Loss

- If the underlying price remains between the two strike prices by expiration, both options expire worthless, and the total premium paid becomes the loss.

Automating the Strangle Strategy with Tradetron

Manually managing a strangle involves constant monitoring of price movements, calculating break-even points, and timely executing adjustments. Automation can simplify this significantly.

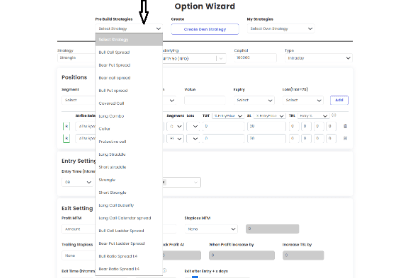

Tradetron allows traders to set up a strangle strategy using a no-code visual builder. With Tradetron, you can:

- Define entry rules (such as implied volatility thresholds or technical indicators).

- Automatically place both call and put orders with pre-defined strikes and expirations.

- Set target profits, stop losses, or dynamic adjustments if the underlying moves sharply.

- Receive real-time notifications and reports, ensuring you stay informed without being glued to your screen.

This automation not only saves time but also ensures the strategy is executed with discipline, eliminating emotional decision-making that often undermines manual trades.

Tradetron Wizard - You can create these strategies by simply updating a few settings in the Tradetron wizard:

https://tradetron.tech/wizard/create

Tradetron also offers pre-built option strategies to help you create your own algo setup. You can customize these strategies by adjusting parameters like time, target, stop loss, and more according to your trading logic.

Conclusion

The strangle option strategy is a powerful tool for traders looking to capitalize on volatility without taking a directional view. While it offers the potential for attractive returns, it also requires careful planning and risk management. Automating your strategy through Tradetron can help you execute with precision, reduce manual stress, and maintain discipline—key factors in long-term trading success.

If you’re ready to explore how automation can transform your approach to options trading, learn more about building custom option strategies with Tradetron.

FAQs About the Strangle Option Strategy

1. How does a strangle differ from a straddle?

A straddle involves buying a call and put at the same strike price, while a strangle uses different strike prices, typically out-of-the-money, making it cheaper but requiring a larger move to be profitable.

2. Can a strangle be sold instead of bought?

Yes. Selling (writing) a strangle generates premium income if you expect low volatility. However, it carries unlimited risk if the market moves sharply.

3. Is a strangle suitable for all traders?

Strangles are best for traders who understand options pricing and volatility. Beginners should use paper trading or start small to become familiar with potential risks.

4. How do you choose strike prices for a strangle?

Strikes are typically set equidistant from the current price, depending on expected volatility. A wider distance lowers premiums but needs a bigger move to profit.

5. Can I automate a strangle strategy without coding?

Yes. Platforms like Tradetron let you build and deploy strangle strategies visually, with automated entry and exit rules, without any programming knowledge.

Made with Superblog

Made with Superblog