Contents

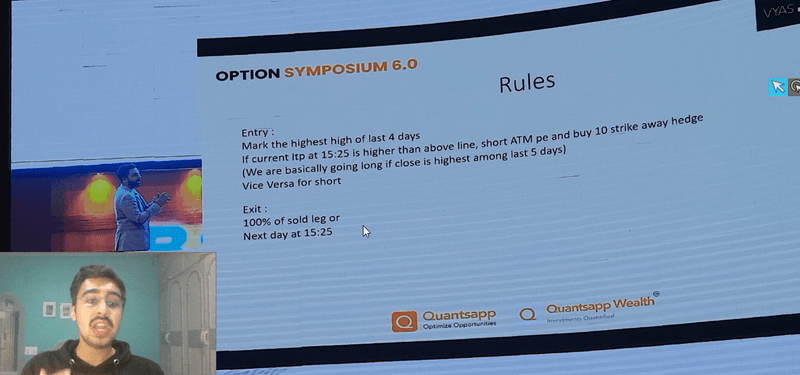

Hey Traders! Today, we're diving into the intriguing strategy unveiled by a speaker at the Option Symposium 2024. We'll break down the logic, build it on Tradetron, and run a backtest to see its historical performance. Buckle up as we unravel the secrets behind this 4-day high-low technique.

Understanding the Strategy

The speaker shared insights at the symposium, touching on various aspects of option trading. Amidst the philosophical discussions, he presented a hands-on strategy focusing on capturing a 4-day high or low. Let's break it down.

The essence of the strategy lies in marking the highest point and the lowest point of the last four days' candles, excluding the current day. If the current day's last traded price (LTP) at 3:25 PM surpasses the highest point, it's a signal to go long. Conversely, if the LTP is below the lowest point, it's time to go short using selling option strategies.

Strategy in Action: Bank Nifty Daily Chart

Let's visualize this strategy using Bank Nifty on the daily timeframe. Imagine we're at the red candle, representing the current day. We look back at the last four days, mark the highs and lows, and check the LTP at 3:25 PM.

If the price is above the high point, it's a green light for a long trade. On the other hand, if it's below the low point, we initiate a short trade using call options, hedged appropriately.

Building the Strategy on Tradetron

Now, let's translate this concept into Tradetron. I've pre-built the strategy, and you can duplicate it for a detailed look. In Set 1, we're setting conditions for a long trade, checking if the LTP is above the highest high of the last four days. The position details ensure no open positions, and a days difference condition aids in handling certain scenarios.

For the short strategy in Set 2, we follow a similar approach but focus on the lowest low of the last four days. It's all about meticulous conditions and logic.

Position Management and Hedging

In both long and short scenarios, we use ATM options and hedge them by buying options 10 strikes away. This asymmetry ensures a conservative approach for short trades while maximizing potential gains for long trades.

Handling Expiry Days

An essential consideration is handling expiry days. The strategy distinguishes between regular days and expiry days. On expiry days (set 3 and set 4), it adjusts the expiry of the options to the next week, avoiding unnecessary complications.

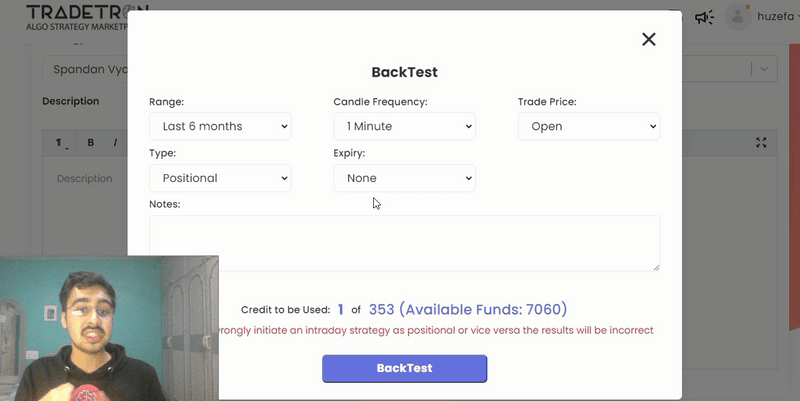

Backtesting the Strategy

With the strategy set, it's time to backtest. Remember, since this is a positional strategy without a universal exit, select "None" for expiry in the backtest settings.

Upon analysis, we observe a decent PNL curve with a win rate of 63.93%. The strategy has a unique characteristic – the average loss on a losing day is higher than the average profit on a winning day. Yet, the higher win rate contributes to an overall positive PNL curve.

Fine-Tuning for Optimal Results

Feel free to experiment with different parameters. Adjust the hedge, try different strike differences, and explore variations. Trading is dynamic, and what works best may vary. The strategy's low number of trades per day keeps brokerage costs in check.

Conclusion: Take it for a Spin!

The 4-day high-low strategy, translated into an algorithmic approach, offers a unique perspective on option trading. It's not a one-size-fits-all solution, so tweak and experiment to find what suits your risk appetite and market conditions.

Duplicate the strategy, test it, and share your findings. Trading is a journey of continuous learning and adaptation. If you have suggestions or topics for future videos, drop them in the comments. Happy trading!

Made with Superblog

Made with Superblog