Contents

Hey Traders, buckle up because today we're diving into mixing different type of spreads to make a hybrid trading strategy. You know, as traders, we're always on the lookout for ways to maximize our returns while minimizing risk. And that's where option spread strategies come into play, offering a unique blend of positional directional and non-directional setups that can supercharge your trading game.

Understanding Hybrid Strategies: The Best of Both Worlds

So, what exactly are hybrid strategies? Well, think of them as the ultimate fusion of two distinct trading approaches. On one hand, you've got directional setups, where you're betting on the market moving in a specific direction. On the other hand, you've got non-directional setups, where you're agnostic about market direction and aim to profit from range-bound conditions.

The beauty of hybrid strategies lies in their versatility. They allow you to capture upside potential when the market moves in your favor, while also providing protection against adverse movements or sideways trends. It's like having the best of both worlds at your fingertips.

Building a Hybrid Strategy: Mixing Bull Call Spread with Short Strangle

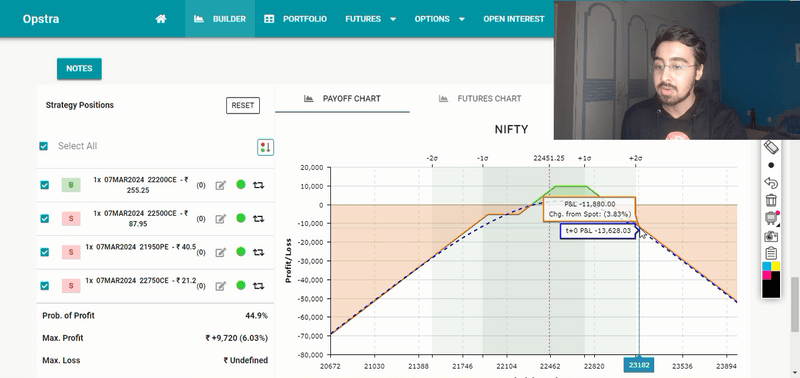

Now, let's roll up our sleeves and get into the nitty-gritty of building a hybrid strategy using the Option Wizard on Tradetron. Picture this: we're crafting a strategy that combines the bullish outlook of a bull call spread with the neutrality of a short strangle.

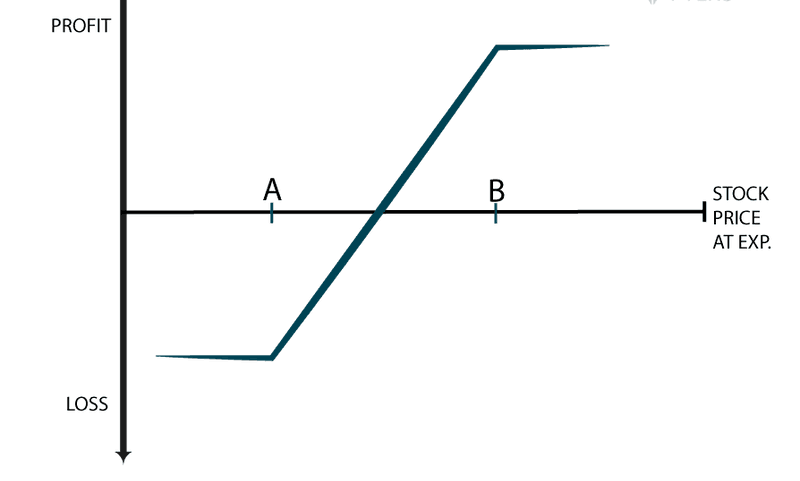

For our bull call spread, we're selecting two call options with different strike prices – one in the money and one out of the money. This allows us to profit from upward market movements while limiting our downside risk.

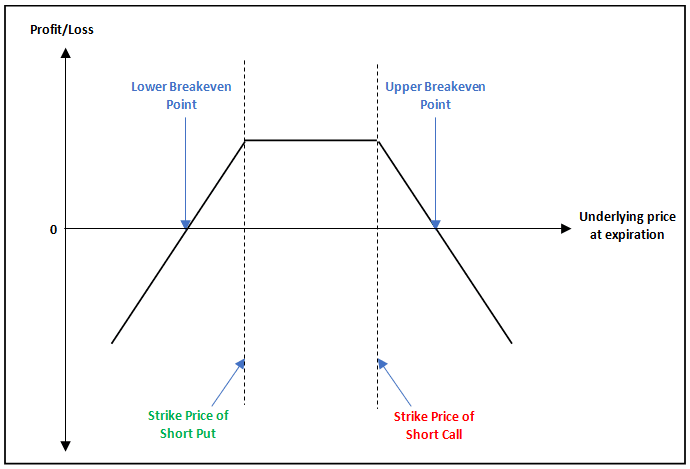

On the other hand, our short strangle involves selling both an out-of-the-money call and an out-of-the-money put. This strategy thrives in sideways markets, allowing us to collect premiums while minimizing our exposure to directional risk.

By blending these two strategies together, we create a powerful hybrid spread that offers the potential for significant profits if the market moves in our favor, while also providing protection in case of adverse movements or range-bound conditions.

Managing Risk: Setting Stop Losses and Exit Criteria

Of course, no trading strategy is complete without proper risk management. That's why we're implementing stop-losses and exit criteria to safeguard our capital and minimize potential losses.

Using Tradetron's intuitive interface, we set our stop-loss based on our maximum acceptable loss, ensuring that we exit the trade if it moves against us beyond a certain threshold. This helps us maintain discipline and avoid catastrophic losses in volatile market conditions.

Additionally, we set our exit criteria to trigger on the expiry day, allowing us to lock in profits or cut our losses based on our predefined parameters. This ensures that we stay nimble and adaptive, ready to capitalize on market opportunities while mitigating downside risk.

Testing and Refining: The Path to Trading Mastery

Once our hybrid strategy is set up, it's time to put it to the test. We can backtest it over historical data to gauge its performance under various market conditions, allowing us to identify strengths, weaknesses, and areas for improvement.

Through iterative testing and refinement, we can fine-tune our strategy parameters, optimize our risk-reward profile, and increase our chances of success in live trading. It's a continuous learning process, but one that can ultimately lead to trading mastery.

Conclusion: Embracing the Hybrid Revolution

In conclusion, hybrid trading strategies offer a powerful blend of directional and non-directional approaches, providing traders with enhanced flexibility, profitability, and risk management capabilities. By harnessing the power of , traders can craft sophisticated hybrid spreads that adapt to changing market conditions and deliver consistent results over time.

Ready to Take the Plunge?

If you're eager to explore the world of hybrid algo trading strategies, check out the link in the description to access the strategy we've discussed in this blog. Feel free to duplicate it, tweak it, and test it to suit your unique trading style and preferences. And remember, the journey to trading mastery begins with a single step – so why not take that step today?

Happy trading, folks!

Made with Superblog

Made with Superblog