Contents

Introduction

Greetings, fellow traders! The Option Symposium 6.0 in Mumbai 2024 was a great event for those seeking innovative trading strategies. Among the lineup of speakers, Pushkar Raj Thakur, a prominent YouTube personality, stole the spotlight with his trading approach. In this blog post, we delve into Pushparaj's Super Trend strategy – and convert it into an algo strategy.

Double Super Trend Strategy

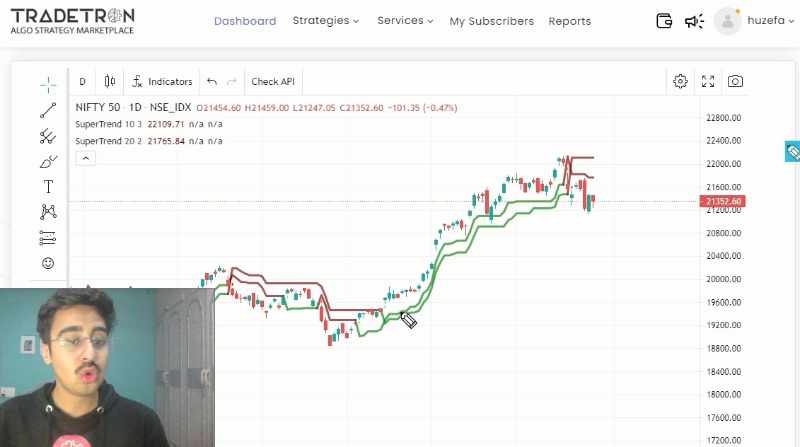

Pushparaj's approach centers around utilizing two distinct Super Trends on the Nifty50 index – the 10-3 Super Trend for slow movements and the 20-2 Super Trend for faster shifts. The magic happens when these Super Trends synchronize in color, providing a clear signal for market direction.

- Long Trades: Both Super Trends in green.

- Short Trades: Both Super Trends in red.

It's a foolproof system: follow the color code, and you're on the right track. But, as both point at different colours you adbandon the position and wait for another confrimation of trend.

Practical Implementation

Now, let's talk about applying this strategy in the real world. For long trades (both Super Trends green), Pushparaj recommends going in with two lots. Conversely, for short trades (both Super Trends red), a single lot is sufficient. This strategic asymmetry optimizes the strength of the system in capturing upward trends while being conservative with downward movements.

Timing is Everything

When to enter and exit is the next logical question. For long trades, the entry trigger is if the conditions anytime after the market opens. However, our personal bias advises waiting until after 10:00 AM to confirm the trend direction, considering early market volatility. An exit is triggered if both Super Trends suddenly switch sides, ensuring timely responses to market shifts.

Managing Monthly Expiries

One of the strategic nuances is managing monthly expiries. If a trade initiated in one month is still viable in the next, the strategy closes the previous position and opens a new one. This adaptability ensures relevance in changing market conditions and reflects the forward-thinking approach of the strategy.

Practicality in Action

What sets Pushparaj's strategy apart is its practicality. This isn't just a theoretical concept; it's something you can implement using the Tradetron chart. The step-by-step breakdown and the provision to duplicate and test the strategy provide traders with the tools to experiment with different parameters.

High risk and low risk approach

While the original strategy takes trades in futures however not everyone would be confrorable to take long and short directional trades in the Futures segment. A low risk approach would be to take a bull call and bear put spread at the 30/60 delta levels. You can have a look at the attached video to check the strategy build and backtest.

Final Thoughts

While Pushparaj's strategy shows immense promise, remember that no strategy guarantees success in the unpredictable world of trading. It's crucial to backtest thoroughly, understand the risks involved, and, if possible, consult with financial experts before diving in. Happy trading, and may your charts be ever in your favor!

Made with Superblog

Made with Superblog