What is Trailing Stop Loss?

A dynamic way of managing risk is to capture every move in your direction.

The trailing stop loss (TSL) commonly referred to as TSL does just that.

Trailing stop loss helps you capture the upside when your trade is in your favour and adjust the downside when it's not.

While we are all familiar with practically using a 'trailing stop loss order' on various broker platforms, the trailing stop loss feature on Tradetron is an extremely powerful tool to let your winners run and exit the losers.

This also means that it is one of the most misunderstood tools of Tradetron.

This blog post will try to demystify some of the common misconceptions around the usage of the TSL.

TSL Vs TSL order

What we traders colloquially call trailing stop loss is in reality a trailing stop loss order.

A TSL in an algo setup is not achieved through individual orders but through a calculation based on the overall PNL of your strategy.

It is important to note that when the trailing stop loss in an algorithm is achieved, it simply closes all open positions through a Universal exit.

This is quite different as compared to a broker's TSL order where the broker is continuously modifying the order that was sent to the exchange based on your trailing inputs.

How to activate the trailing stop loss?

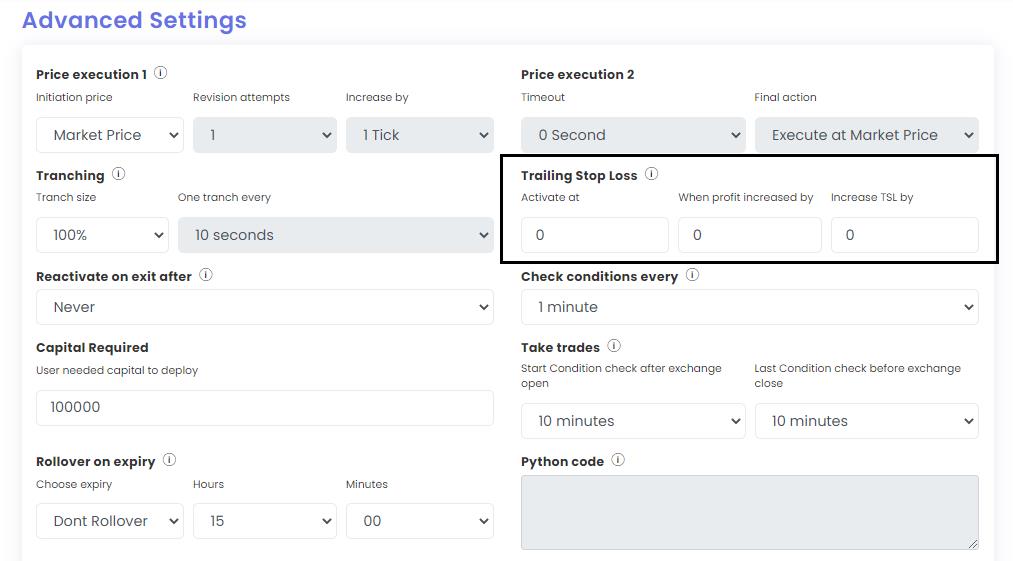

The trailing stop loss (TSL)can be found in the advanced settings of the strategy creation page of Tradetron.

You will notice that the values are set as zero by default. This means that the trailing stop loss is not currently activated.

In order to activate this feature, simply add values in all three boxes.

What values to add?

Let us explain.

Activate at:

Once you have entered into your strategy, every time your strategies conditions are checked, the Tradetron server will lock a value based on your PNL.

Activate at is the PNL after which your trailing stop loss mechanism gets activated.

Let's assume you set 'activate at' as 1000.

Your trailing stop loss will now be activated only after your strategy has an overall profit of 1000 rupees.

Once activate at is set, your TSL is now set at a PNL of 0 rupees.

When profit increased by:

After your ‘activate at’ price has been breached and the TSL mechanism has been activated, whenever the profit increases by the number inserted here, the TSL will be shifted up.

This gives you the flexibility to trail your profit in any ratio you like. A 1:1 trail can be achieved by keeping the ‘profit increased by’ and ‘increase TSL by’ values the same number.

Increase TSL by:

Once the overall profit is greater than the ‘activate at’ price and the ‘profit increased by’ price, the TSL will now shift from zero to the number you set here.

We understand that this might sound a bit complicated to understand, but it gets fairly straightforward once we break it down in the form of an example.

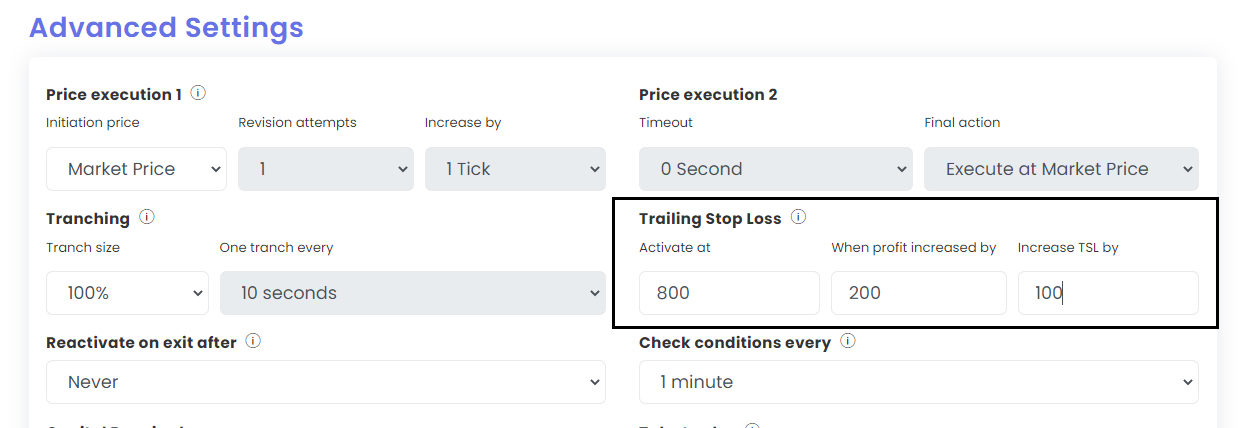

Let's assume we have the following TSL parameters set in a strategy.

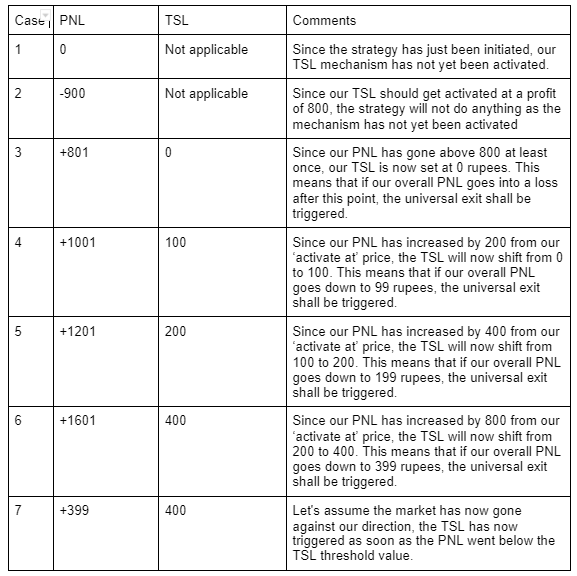

Based on the values shown let's consider what will happen in each case shown below:

At this point it is important to note that the TSL works on a strategy level and not on a set level.

Thus the overall PNL calculation for TSL happens on the realised as well as the unrealised profit or loss of your strategy. The TSL will only reset if your run counter changes.

Moreover the TSL feature has been configured to be automatically adjusted as per the multiplier of your deployment.

For example if you have selected a 2X multiplier on the ‘deployed’ page for your strategy, the TSL values will also be doubled.

Checking trailing stop loss metrics from runtime data

While setting a couple of values in some boxes may be easy, it's always a good practice to check how and where the trailing stop losses trigger in order to optimise a strategy.

Every time a strategy is executed, there are some variables that are created.

Since the trailing stop loss conditions may not always come true, whenever TSL is activated, a runtime variable will be generated.

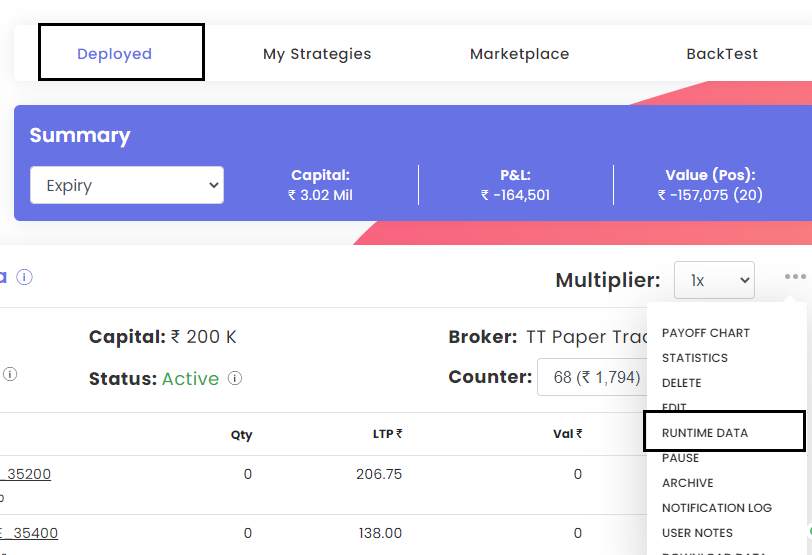

In order to open the runtime data, Go to the deployed page and find your strategy.

Look for the three dots next to the same, click on it and scroll down, you will see 'runtime data'. The runtime data is only visible to the creator of the strategy.

How to find out if the trailing stop loss feature was activated?

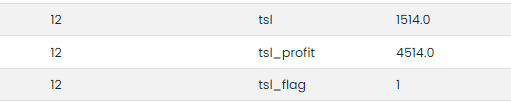

If you see ‘tsl_flag’ in the column under the ‘key’ column, and an attribute of '1' next to it, your TSL feature has been activated.

Going forward the system will keep checking for the ‘profit increased by’ value set.

How to find the max profit achieved in a run counter?

Within the runtime data dialogue box you will see 'tsl_profit' with a value next to it.

This is the maximum recorded profit figure achieved by your strategy.

This includes the realized and unrealized profit and loss of all the positions.

What was the stop loss set as?

In the same runtime dialog box, you will see tsl. The value next to the same TSL shall be the trailing stop loss for consideration.

If your algo trading strategy has not already been executed, your TSL may keep updating depending on the maximum profit achieved by your strategy.

Frequently Asked Questions On Trailing Stop Loss

1. How does a trailing stop loss work?

A trailing stop loss is a type of order used in trading that helps protect profits and minimize losses.

It's called "trailing" because it follows the price of an asset as it moves up, allowing traders to lock in gains while also giving room for potential upsides.

Here's how it works: let's say you buy a stock at $50 and set a trailing stop loss at 5%.

This means that if the stock falls by more than 5%, your position will automatically be sold, limiting your losses.

However, if the stock rises to $55, your trailing stop loss will adjust accordingly - now set at $52.25 (5% below $55).

This way, you can continue to ride the upward trend while still having protection against any sudden downturns.

Traders often use this strategy when they're uncertain about market movements or when they want to take advantage of volatile markets.

It allows them to focus on other opportunities without worrying about constantly monitoring their positions.

Overall, using a trailing stop loss can help mitigate risk and increase profitability in trading by providing an automated safety net for investors looking to diversify their portfolios.

2. What Is a Trailing Stop?

A trailing stop is a type of order used in trading to automatically adjust the stop loss level as the price of an asset moves in favor of the trader's position.

Essentially, it "trails" or follows the price movement.

When placing a trailing stop order, you set a percentage or dollar amount below the current market price (for long positions) or above (for short positions).

As the market moves up, your trailing stop will follow it, maintaining that same percentage distance from the new high.

If the market then reverses and drops by that predetermined percentage amount, your trade will be closed out at that point.

This type of order allows traders to lock-in profits while minimizing potential losses.

It can also be useful when there are sudden fluctuations in volatility since it helps prevent being stopped out prematurely due to temporary spikes.

3. Is trailing stop loss better?

Trailing stop loss is a widely used tool in the financial markets, and it has gained popularity among traders due to its effectiveness.

In simple terms, trailing stop loss refers to an automated order that adjusts the stop-loss level as per the market movement.

Trailing stop loss is better than conventional stop-loss orders since it allows traders to limit their losses while also allowing them to benefit from favorable price movements.

This means that if the price of an asset moves up in favor of your position, your trailing-stop will move with it, ensuring that you lock-in profits while still protecting your downside.

4. Which broker provides trailing stop loss?

There are several brokers that provide trailing stop loss for their clients, including well-known names such as Tradetron.

If you're looking for a broker that provides robust risk management tools like trailing stops, Tradetron may be worth considering. Just be sure to do your research on fees and other factors before choosing any broker or trading platform.

5. Is Trailing Stop a good strategy?

Yes, a trailing stop can be an effective strategy for managing risk and maximizing profits in trading.

A trailing stop is essentially a type of order that automatically adjusts to follow the market price as it moves in favor of the trader's position.

This means that if the market starts moving against the trader, their position will be automatically closed out at a predetermined point.

6. What is a disadvantage of a trailing stop loss?

A disadvantage of a trailing stop loss is that it can potentially lock in losses prematurely.

When the market experiences a temporary dip or fluctuation, the trailing stop loss will trigger and sell the asset at a lower price than its original value, resulting in a loss for the investor.

If there is high volatility in the market, the trailing stop loss may not be able to keep up with rapid changes and fail to provide effective protection against significant losses.

It is important for investors to carefully consider their risk tolerance and use other strategies such as diversification and fundamental analysis alongside trailing stop losses to minimize potential downsides.

We hope this blog helps you understand and optimise your trailing stop loss strategies.

If you feel there is something else you would like us to cover here, please feel free to share your views with us at [email protected].

Made with Superblog

Made with Superblog