In India, stock trading is gaining in popularity as more people are looking to increase their wealth by investing. Navigating the stock market can be overwhelming for beginners. This guide will explain the basics of stock trading for beginners, and show you how to start.

1. Understanding the Basics of Stock Trading

Stock trading is the act of buying and selling publicly traded shares to make profits. Stock trading in India is primarily conducted on two major exchanges, The National Stock Exchange (NSE), and The Bombay Stock Exchange . To make informed decisions, traders use a variety of strategies and analytical methods.

2. Key Players in the Indian Stock Market

SEBI (Securities and Exchange Board of India ): Regulates and supervises stock market activity.

Stock Exchanges: Platforms for buying and selling stocks.

Retail Investors: Individual traders and large financial organizations participating in the market.

3. Steps to Start Stock Trading in India

Step 1: Open a Demat and Trading Account

You need to open a Trading and Demat account at a SEBI registered broker in order to start stock trading. To complete the process, you will be required to submit documents such as Aadhaar and PAN card details, bank account information, and address proof.

Step 2: Learn how to analyze stocks

Understanding stock analysis before making any trades is essential.

Basic Analysis: Evaluation of a company's earnings, financial health and growth potential.

Technical analysis: Use charts, patterns and indicators to predict the price movement.

Step 3: Understanding the Different Types Of Trading

Intraday trading: buying and selling stocks on the same day.

Delivery Trading : Holding stock for longer periods to make profits over time.

Swing trading: Capturing price fluctuations for quick gains.

Positional trading: Holding stock for several weeks or months, based on trends.

Step 4: Placing Your First Trade

Follow these steps once you have selected your stock to make your first trade.

Log into your trading account.

Find the stock that you wish to trade.

Select the type of order.

Enter the quantity, and confirm your trade.

Step 5: Managing Risk & Portfolio

Risk management is a key element for successful traders. Here are some key tips.

Diversification: Invest in various sectors to reduce risk.

Stop Loss Orders : Sell stocks automatically at a loss limit pre-set.

Position Size: Do not invest too much money in one stock.

4. Common Mistakes Beginners Should Avoid

Investing without proper research.

Following stock market tips blindly.

Overtrading and emotional trading.

Neglecting stop-loss strategies and risk management.

5. Best Resources to Learn Stock Trading in India

Consider the following resources to become a skilled trader:

Online courses: platforms like Udemy Zerodha Varsity and NSE Academy.

Books: Read "The Intelligent Investor" by Benjamin Graham and read "Common Stocks and Uncommon Profits", by Philip Fisher.

YouTube Channels: Follow experts such as Pranjal Kamra and CA Rachana Ranade.

Financial News : Stay up to date with the latest market trends by visiting Moneycontrol, Economic Times and BloombergQuint.

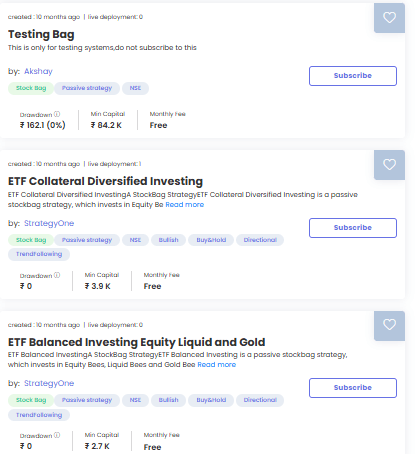

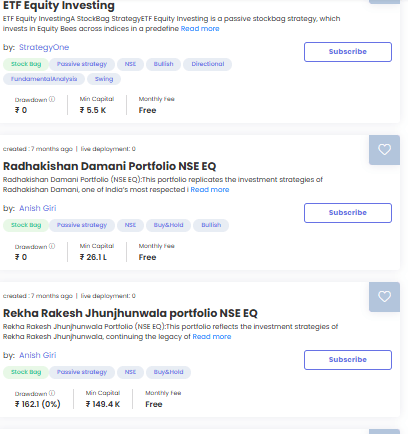

the Stockbags you can try using Tradetron if you dont know what stocks to buy/sell etcIf you're unsure about which stocks to buy or sell, consider using Stockbags on the Tradetron platform to help you make informed decisions. There are prebuilt Stockbags which you can use.

https://tradetron.tech/strategies?searchString=&StockBag=on

Conclusion

Stock trading in India is a great way to create wealth, but it takes patience and discipline. Begin with small investments and learn how to manage your risk. You can also improve your trading skills by learning new techniques. Good luck with your trading!

FAQs

1. How much money do I need to start stock trading in India?

You can start with as little as ₹500, but it's advisable to begin with a larger sum for meaningful gains.

2. Which is the best stockbroker for beginners?

There are many SEBI-registered brokers available, and the choice depends on personal preference and features offered.

3. What are the risks involved in stock trading?

Stock trading involves risks such as market volatility, liquidity issues, and economic fluctuations.

4. Can I do stock trading without a Demat account?

For intraday trading, a Demat account is not mandatory, but for holding stocks, it is required.

5. Is stock trading in India safe for beginners?

Yes, with proper research, risk management, and discipline, stock trading can be safe and profitable.

Made with Superblog

Made with Superblog