Contents

Basics

Let’s understand intraday trading with a strategy unveiled by Dharmik at a recent event. This strategy may sound complex, but fear not! We'll break it down into simple steps, explain the key concepts, and show you how to replicate it in your Tron account. Let's get started!

Understanding Dharmik's Strategy:

Dharmik's strategy revolves around intraday trading, focusing on options. In essence, it involves shorting the first out-of-the-money (OTM) call and put options, setting a stop-loss at 40% and a target at 50%. But what makes this strategy unique is the use of synthetic futures.

What Are Synthetic Futures?:

Synthetic futures might sound intimidating, but they're actually quite straightforward. Think of them as a calculated value derived from the spot price and options premiums. They help bridge the gap between spot prices and futures prices for a specific expiry, enabling traders to select strike prices more accurately.

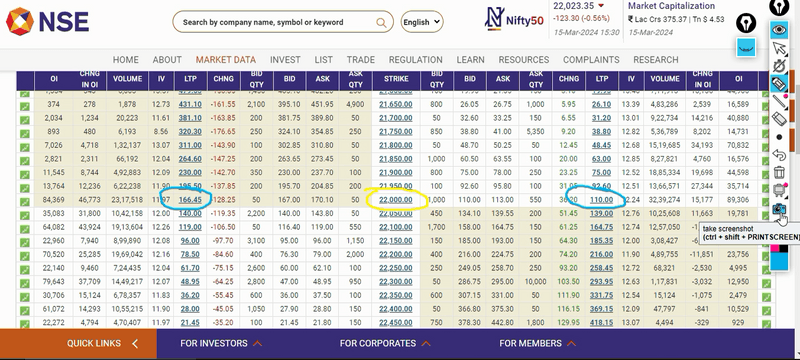

Calculating Synthetic Futures:

To calculate synthetic futures, you simply add the premium of the call option and subtract the premium of the put option for a particular strike price. This gives you a value that closely resembles what the futures price would be if there were futures contracts available for the current week's expiry.

Synthetic Futures = Strike price + Call premium - Put premium

Example:

Strike = 22000LTP of the 22000 CE = 166

LTP of the 22000PE = 110

Synthetic futures => Strike price + Call premium - Put premium

=> 22000 + 166 - 110

=> 22056

Implementing Dharmik's Strategy:

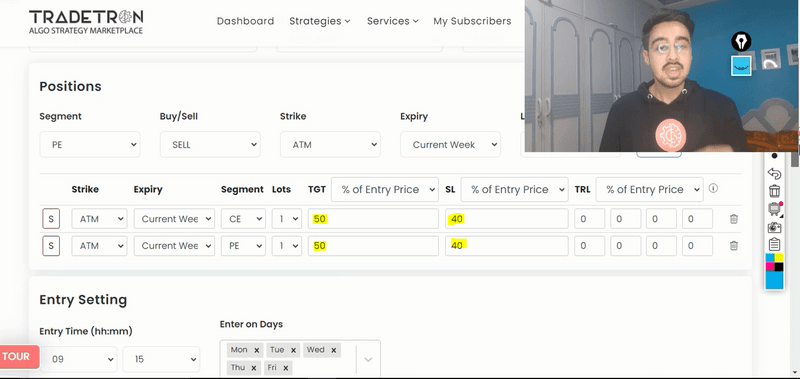

Now, let's put Dharmik's strategy into action. I'll guide you through replicating it in your Tradetron account. Simply follow the steps provided in the link below the video, and you'll have the strategy duplicated in your account in no time.

Building the Strategy in Tradetron:

Replicating the strategy involves setting up parameters such as capital allocation, entry time, stop-loss, and target levels. You'll also need to tweak the position builder to use strike prices based on synthetic futures, ensuring precision in your trades.

Testing and Modifications:

Once the strategy is set up, it's crucial to test it thoroughly before deploying it in live markets. Tradetron allows you to backtest the strategy, enabling you to assess its historical performance and make any necessary adjustments.

Conclusion:

By understanding Dharmik's intraday trading strategy and leveraging synthetic futures, you're equipped to navigate the complexities of options trading with confidence. Remember, practice makes perfect, so don't hesitate to paper trade the strategy before going live.

Feedback and Future Requests:

If you found this guide helpful, be sure to like and comment on the video. Your feedback is invaluable and helps us improve our content. Have suggestions for future topics or questions about the strategy? Feel free to drop them in the comments section or reach out via email.

In this beginner-friendly guide, we've broken down Dharmik's intraday trading strategy into simple steps, explained the concept of synthetic futures, and demonstrated how to replicate the strategy in your Tron account. With this knowledge, you're ready to embark on your intraday trading journey with confidence.

Made with Superblog

Made with Superblog