Introduction

Are you intrigued by the prospect of diving into the world of intraday option trading but find yourself daunted by the complexities involved? Fear not, for we're about to unravel the intricacies of setting up and backtesting an intraday option selling hedge strategy using Tradetron, a cutting-edge techniques for algorithmic trading.

Understanding the Strategy

Check out the below video to understand the strategy we will build and as a bonus find the link to duplicate this strategy below:

Implementing the Strategy on Tradetron

Now comes the exciting part – implementing this strategy on Tradetron. With just a few clicks, traders can duplicate the strategy in their accounts, enabling seamless execution and paper trading. Leveraging Tradetron's intuitive interface, traders can fine-tune parameters, adjust lot sizes, and set up automated hedging mechanisms with ease.

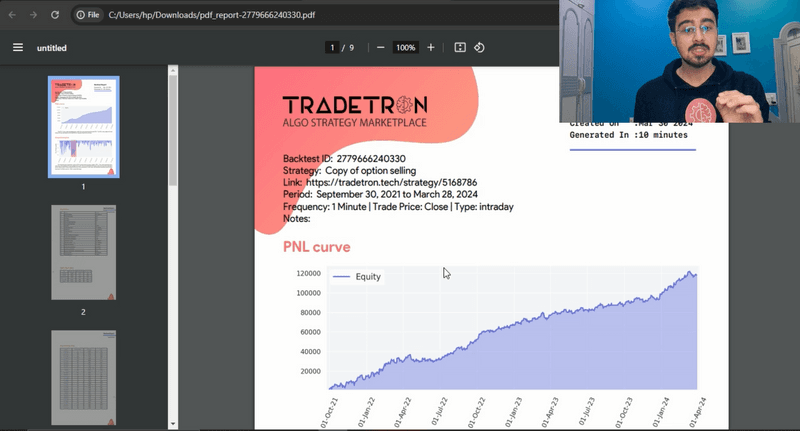

Backtesting for Optimization

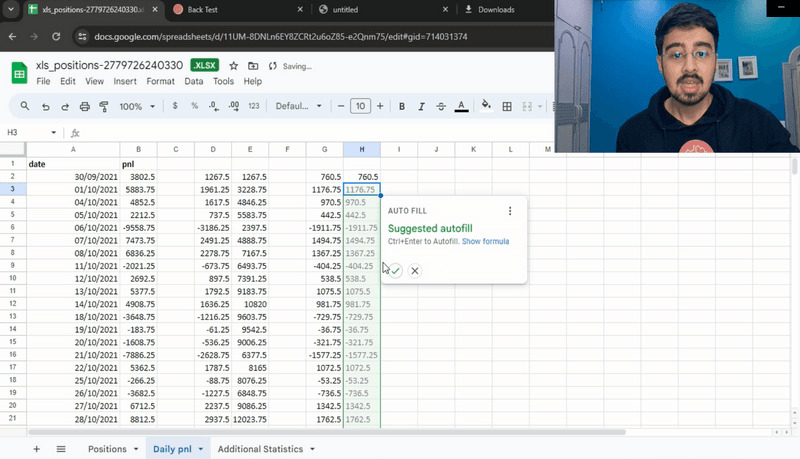

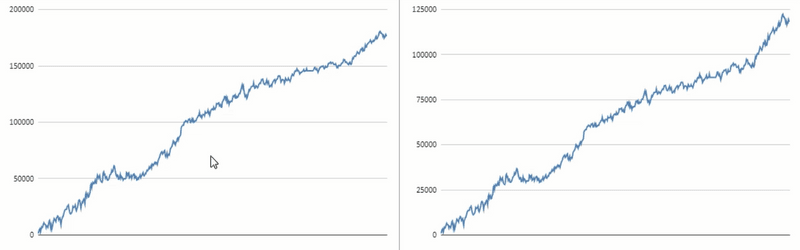

But wait, before diving headlong into live trading, it's crucial to conduct thorough backtesting to validate the strategy's efficacy. Backtesting involves running the strategy on historical data to gauge its performance under various market conditions. By adjusting lot sizes and analyzing historical P&L curves, traders can glean invaluable insights into the strategy's robustness and adaptability.

Optimizing Strategy Performance

Armed with backtest data and insights, traders can fine-tune their strategies, optimizing performance and maximizing profitability. By incorporating learnings from backtests, traders can mitigate risks, capitalize on opportunities, and stay ahead of the curve in an ever-evolving market landscape.

Addressing Lot Size Discrepancies

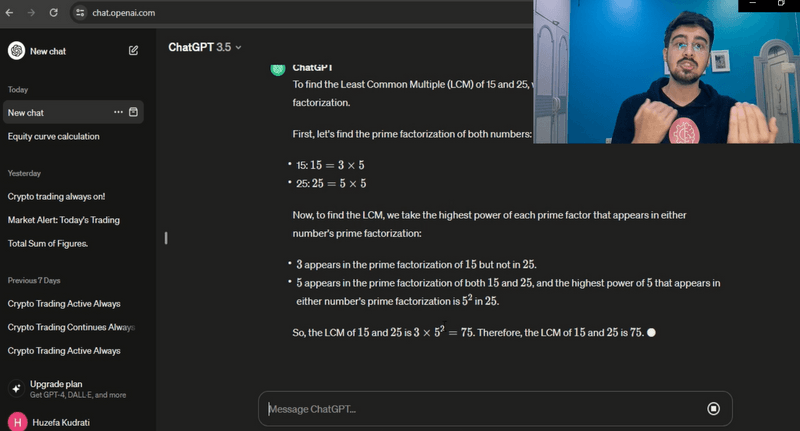

A critical aspect of strategy evaluation involves addressing discrepancies arising from changes in lot sizes over time. To ensure accurate performance assessment, traders must standardize lot sizes across different periods. This can be achieved by identifying the least common multiple (LCM) of previous and current lot sizes and adjusting strategy quantities accordingly.

Standardizing Lot Size for Equitable Comparison

Standardizing lot sizes facilitates equitable comparison of strategy performance across different periods. By multiplying strategy quantities to match a standardized lot size, traders ensure consistency in execution and accurate evaluation of strategy effectiveness.

Interpreting Performance Discrepancies

Interpreting performance discrepancies resulting from changes in lot sizes is essential for informed decision-making. By understanding the impact of lot size variations on strategy profitability, traders can make adjustments to optimize performance and achieve consistent results.

Conclusion

In conclusion, Tradetron empowers traders to navigate the complexities of intraday option trading with confidence and precision. By leveraging its advanced features for strategy deployment, backtesting, and optimization, traders can embark on a journey towards consistent profitability and trading success. Here is an in depth video on how we did this.

Ready to unleash the full potential of intraday option trading? Dive into the world of Tradetron and embark on your trading journey today!

Made with Superblog

Made with Superblog