Contents

Introduction:

Today, we're going to unravel a fascinating trading strategy specifically tailored for Nifty Financial Services aka Finnifty. The strategy we'll delve into isn't an original creation; credit goes to Trading with Groww for bringing it to our attention. Our goal is to not just understand this strategy but to walk you through building and backtesting it on Tradetron.

Understanding the Strategy:

Let's start with the basics. This strategy focuses on Fin Nifty (commonly known as Nifty Financial Services). The strategy kicks off at 9:20 AM. At this point, we're honing in on the in-the-money call and put options for fin Nifty. A quick example: if fin Nifty sits at 21,000, we're interested in the 20,900 call and the 21,100 put. Both these options are closed out at precisely 9:20 AM.

Here's the twist:

Unlike traditional strategies with specific targets and stop-loss levels for each instrument, this strategy bases its targets and stop-loss on the movement of the underlying asset. If, after the initial trade, Fin Nifty moves by 0.4%, it triggers the closing of the open call and put positions. Then, new in-the-money call and put options are identified, initiating a loop that continues until 3:20 PM. After this, the trading day concludes, and the gains or losses are tallied.

Building the Logic on Tradetron:

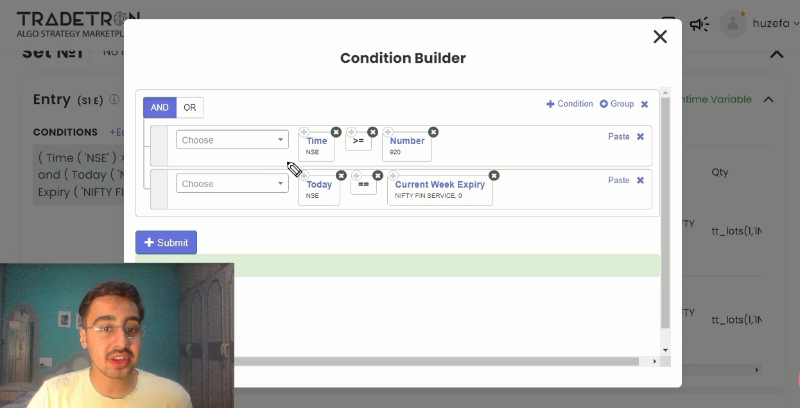

Let's break down how this logic is translated into the Tradetron platform. The entry conditions involve checking if the time is greater than or equal to 9:20 AM and if it's a Tuesday or the expiry day of fin Nifty's current week. This ensures that trades are limited to specific days.

The position builder is responsible for constructing a straightforward position for the in-the-money call of fin Nifty's current week expiry with one lot. The strike is set as the at-the-money (ATM) option, which is determined using the "ATM" keyword. For the in-the-money call, an offset of minus one is used, signifying the strike one level above the ATM.

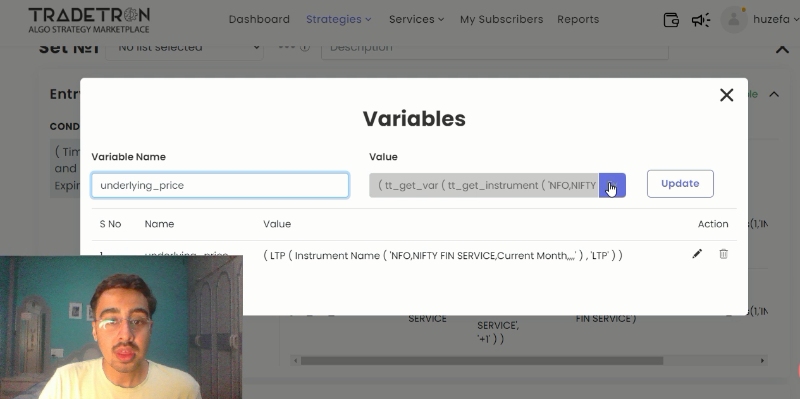

To capture the underlying's price at entry, a runtime variable named "underlying price" is created. Exit conditions come into play when comparing the last traded price (LTP) to the underlying price. If the LTP increases by 0.4%, it triggers a square-off. This process repeats until 3:20 PM. Advanced settings include the option to reactivate the strategy after 6 hours or any other desired timeframe.

Backtesting and Results:

With the logic set up, it's time for a backtest. However, it's essential to bear in mind that backtesting provides a relative comparison. The performance observed in a backtest may not be directly replicable in live trading due to the differences in data structures – one-minute historic data versus real-time continuous data.

The backtest results reveal a steady curve. Flat periods represent weeks with no trades, a normal occurrence since the strategy only takes trades once a week. The statistical data provided allows us to gauge the strategy's performance.

Key Takeaways and Caution:

1. Continuous Data vs. Backtest Data:

It's crucial to understand the difference between continuous real-time data and one-minute historic data when interpreting backtest results.

2. Relative Comparison:

Backtesting is a tool for relative comparisons. Experiment with different parameters to find the optimal risk-adjusted returns.

Simplifying the Insights:

In simpler terms, this strategy revolves around observing and reacting to movements in fin Nifty. It kicks off at 9:20 AM, looking at specific call and put options. The clever part is that instead of setting fixed targets and stop-loss levels for each option, it monitors the broader movement of fin Nifty. If it moves by 0.4%, the open positions are closed, and new ones are initiated.

Conclusion:

In conclusion, we've walked through the entire process of understanding, building, and backtesting an expiry trading strategy on Nifty Financial Services. Backtests are like practice runs – invaluable for refining strategies. However, remember that real-time performance might differ due to variations in data structures.

Use the insights gained from backtesting to adapt and optimize your trading approach. Trading is a dynamic field, and strategies should be flexible to navigate the unpredictable waters effectively. We hope this exploration has been both informative and enlightening.

For those eager to delve into the world of trading or seasoned traders looking for new perspectives, keep those suggestions coming in the comments. Happy trading! 🚀

Duplicate link: https://tradetron.tech/strategy/4202107

Made with Superblog

Made with Superblog