Introduction:

In the trading world, mastering options trading strategies can be the key to unlocking consistency. One such strategy, presented by Theta Gainers in his master class lesson, offers a deep dive into monthly options trading. In this blog, we'll explore the nuances of Theta Gainers's strategy, covering entry points, risk management, adjustments, and the critical process of backtesting for optimization. By dissecting each element, we aim to provide traders with a comprehensive guide to enhance the performance of their monthly options trading strategies.

Understanding the Strategy:

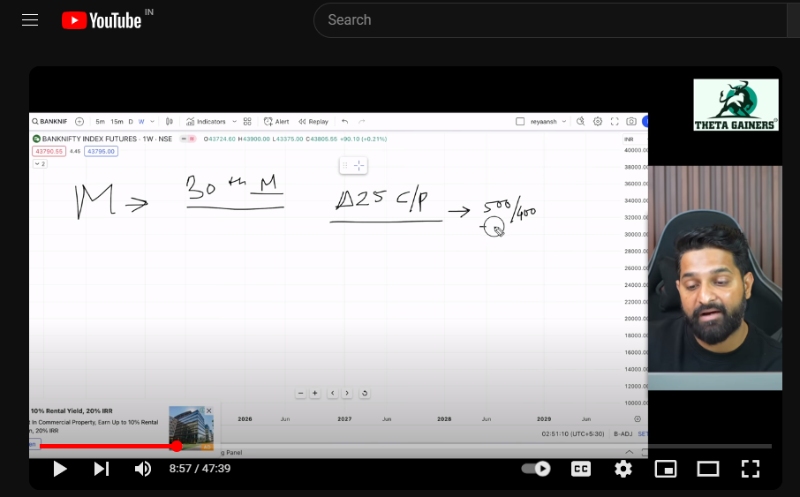

Theta Gainer's monthly options strategy centers around creating an iron condor on Nifty options, focusing on a monthly basis. The entry logic involves strategically shorting call and put options with a delta around +/- 25 in the monthly expiry of Nifty. This initial step sets the foundation for the strategy. To address the inherent risks of overnight positions, a hedge is introduced, positioned 500 points away from the initial setup.

Risk Management and Adjustments:

A key aspect of Theta Gainer's strategy is effective risk management. He highlights the need to keep the probability of profit and the risk-to-reward ratio in favor of the trader. To achieve this delicate balance, adjustments become paramount.

If the market moves beyond a predefined level, Theta Gainers suggests transforming the iron condor into an iron fly. This involves closing two instruments and opening two new ones, effectively rebalancing the risk-reward profile. This adjustment is done when the underlying index moves oustide his green zone. We define this green zone as the strike prices we sold upon entry.

The Exit Strategy:

Knowing when to exit a trade is as crucial as entering it. Gainer's strategy incorporates a nuanced exit plan. Profit booking becomes essential as the expiration date approaches, and a specific target on a favorable risk-reward ratio is achieved.

The strategy also incorporates a universal exit plan, including a trailing stop loss and predefined conditions for closing the strategy. The conditions to the same are discussed in the video at the bottom.

Implementation and Backtesting:

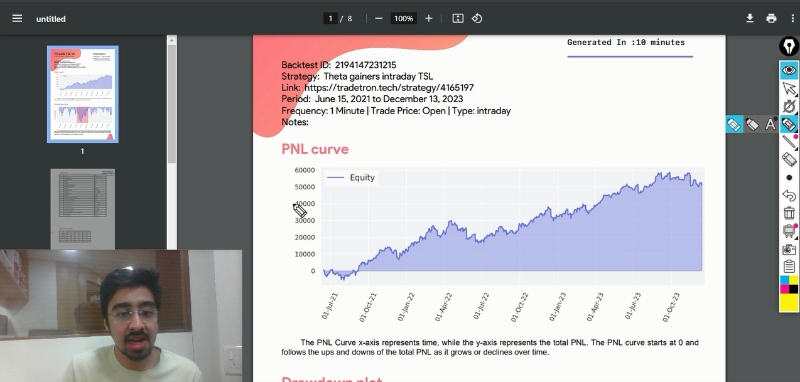

Practical implementation of the strategy is detailed, emphasizing time-based conditions and strike selection. However, the proof of any strategy's effectiveness lies in its historical performance. Backtesting becomes the tool to analyze how the strategy would have fared in various market conditions over time. The initial backtest provides insights into areas that may require optimization.

Optimizing the Strategy:

The blog zooms in on the optimization phase, addressing the identified shortcomings from the initial backtest. A key addition to the strategy is the introduction of a trailing stop loss to limit potential losses. This adjustment aims to reduce the choppiness in the profit and loss (PNL) curve, offering traders a more streamlined approach to risk management.

Exploring Weekly and Intraday Strategies:

In the pursuit of continuous improvement, the blog explores the impact of limiting entries to specific weekdays, shedding light on potential variations in performance. Furthermore, the strategy is tested on a weekly and intraday basis, showcasing its adaptability to different time frames. Through this exploration, the blog provides traders with insights into potential adjustments that could be made based on their preferences and market conditions.

Conclusion:

In conclusion, Theta Gainer's monthly options strategy offers a comprehensive framework for traders to learn about the process of strategy building, testing and optimisation. By emphasizing risk management, strategic adjustments, and meticulous backtesting, the strategy provides a roadmap for success.

Traders are encouraged to explore, duplicate, and adapt the strategy to their preferences, understanding that continuous optimization is key to thriving in the dynamic world of options trading. As the blog concludes, future videos will delve into further iterations and enhancements based on user feedback and evolving market conditions.

Part 1: Strategy Build

Strategy Link: https://tradetron.tech/strategy/4134867

Part 2: Strategy Backtest and Optimisation

Strategy Link: https://tradetron.tech/strategy/4165197

Made with Superblog

Made with Superblog