Are you eager to elevate your trading strategy to new heights? Today, we're diving deep into the world of margin benefit – a powerful tool that can amplify your trades and optimize your strategy for success. Join us as we explore how margin benefit works, its application in scaling up trades, and practical tips for integrating it into your trading strategy.

Understanding Margin Benefit

Margin benefit is a game-changer in the world of trading. Essentially, it allows traders to leverage their capital more efficiently by reducing the margin requirements for certain trades. This means you can take larger positions with less capital, increasing your potential returns while managing risk effectively.

Let's break it down with an example.

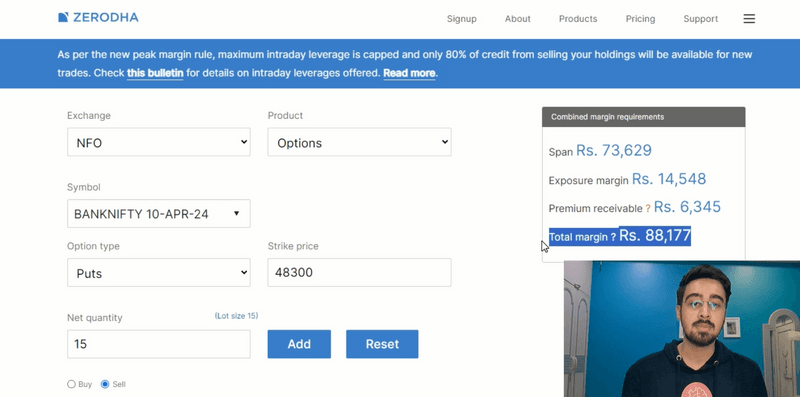

Imagine you're eyeing a put option on Nifty with a strike price of Rs. 48,300.

Traditionally, shorting this option would require a substantial margin, often around Rs. 90,000.

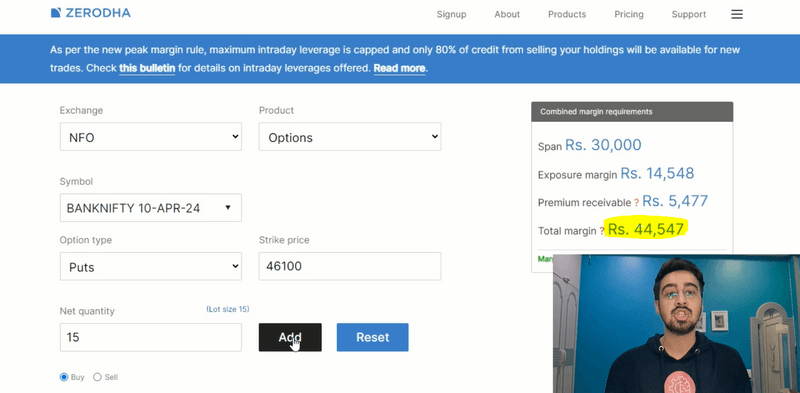

However, by strategically adding a hedge with a lower value, say around Rs. 10, the margin requirement can be significantly reduced to approximately Rs. 44,500. This frees up capital that can be deployed elsewhere, allowing you to maximize your trading opportunities.

Integrating Margin Benefit into Your Strategy

Now that you understand the concept of margin benefit, how can you leverage it to enhance your trading strategy? One effective approach is to modify your existing strategy to take advantage of margin benefit opportunities. For example, you can adjust your entry and exit parameters to optimize margin utilization while maintaining profitability.

Consider a Delta Neutral Intraday Algo Strategy. By incorporating different premium levels for each trading day and diversifying instruments, you can effectively manage margin requirements and enhance trading flexibility. Additionally, by staggering buy and sell orders and strategically adjusting positions, you can ensure optimal margin utilization without compromising profitability.

Optimizing Exit Strategies

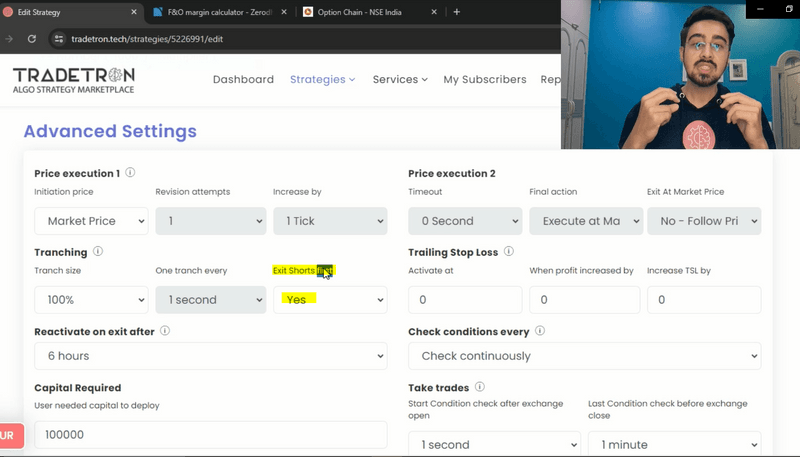

A crucial aspect of maximizing margin benefit is implementing effective exit strategies. To prevent potential margin issues during exit, consider utilizing innovative features like "exit shorts first." This feature prioritizes squaring off sell positions before buys during exit, mitigating margin concerns and ensuring seamless trade closure.

Continual Refinement and Adaptation

As with any trading strategy, continual refinement and adaptation are key to success. Experiment with different parameters, explore advanced settings, and fine-tune your strategy based on real-time market conditions. By staying agile and proactive, you can stay ahead of the curve and capitalize on emerging opportunities.

Conclusion

Margin benefit is a powerful tool that can transform your trading strategy, allowing you to maximize returns while managing risk effectively. By understanding how margin benefit works and integrating it into your strategy, you can unlock new levels of trading success.

Start exploring the potential of margin benefit today and take your trading to the next level!

Made with Superblog

Made with Superblog