Paper Trading

Let’s understand what is Paper trading and how you can paper trade your strategies in Tradetron effectively.

It can be tricky to find your niche in the market. While many successful day traders make a great living from day trading, the majority of traders fail. Don’t let that statistic scare you. Instead, let it ground you and help you take a disciplined approach to your trading. If you are considering becoming a day trader, you want to make sure you give yourself an edge. The best way to do this is through education. Study the market constantly. The most successful day traders are constantly learning new things and adapting to new situations.

Typical education consists of books, videos, courses, etc. While these forms of education are crucial, they cannot prepare you for every situation you will face when day trading. This is where paper trading comes in.

Paper trading is a way of practicing trading without using real money. It allows you to test your strategies and skills in a simulated environment. Paper trading can help you learn about the market, improve your decision making, and avoid costly mistakes.

Tradetron’s papertrading

Tradetron is a powerful platform that empowers traders and investors to design, test, and automate their algorithmic trading strategies. One of its standout features is the paper trading engine, which enables users to simulate their trading algorithms in a risk-free environment before deploying them with real capital. In this article, we'll dive into the world of Tradetron's paper trading engine, exploring how it works, its benefits, and how to get started.

Here's is step by step guide on how you can paper trade your strategies on Tradetron -

Step 1-

In first step you have two options either -

A) You can create your own algo trading strategy on Tradetron using TT – Condition builder

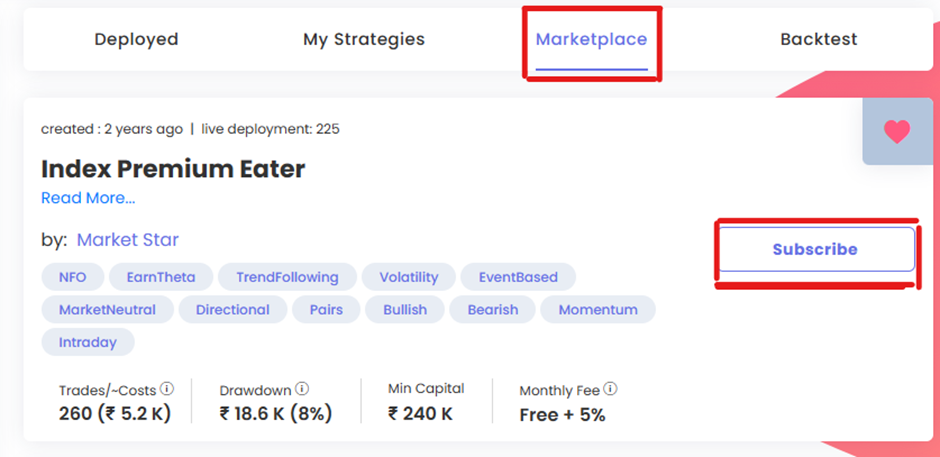

B) You can directly subscribe any of marketplace algo. If you are new to tradetron then its better to watch this youtube playlist - https://youtu.be/2Zt2LWG9mHI?si=NK0X4VdR3a56-ooA where we will explain you how to build algo trading strategy on Tradetron. Here's how you can subscribe to marketplace strategy.You need to go to Tradetron marketplace and then select the strategy and then click on “SUBSCRIBE” Button.

Step 2-

Once you subscribe to marketplace strategy or create your own strategy , all your algo’s are visible under “My strategies” Section. Simply Go to “My strategies” and then click on “Deploy”

Step 3-

Once you click on “Deploy” button you get options to select “Multiplier” , “Execution type” and “Broker” – in case of Live auto strategies. “Multiplier” in Tradetron basically means if you select 2x while deploying it will double the lots. You can select Paper trading under execution type and then click on “Deploy” button

Step 4-

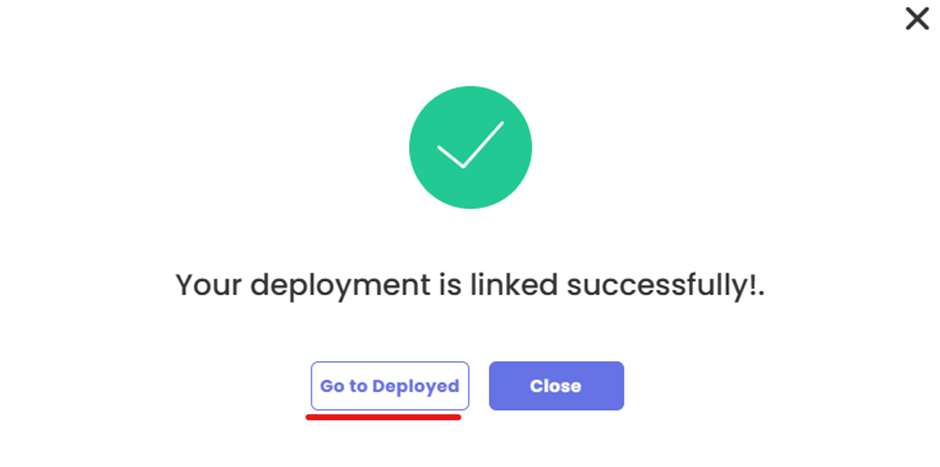

Once you click on Deploy button, Tradetron reply’s you with this message .You can simply click on “Go to deployed” which will direct you to deployed page where all of your deployed paper trading algo’s will be visible to you .

Step 5-

This is the Final step where you can check the open positions of your deployed algo strategy on Tradetron’s deployed page,

If strategy is created by you on Tradetron then you can check the “Notification logs” in which you can understand the Entry – exit criteria of your algo and on the basis of that you can even fine tune your algo trading strategy. Deployed page is filled with lots of options - you can pause or exit the algo strategy from deployed page itself.

Key Benefits of Tradetron's Paper Trading Engine

- 1. Risk-Free Testing: The most obvious benefit of paper trading is the ability to test your algo trading strategies without any financial risk. You can experiment with various algorithms, fine-tune them, and ensure they meet your trading objectives.

- 2. Realistic Market Conditions: Tradetron's paper trading engine simulates real market conditions, including price movements, order execution, and PNL based exits.This creates a lifelike testing environment to make more accurate assessments.

- 3. In-Depth Analysis: The platform provides detailed performance metrics and historical data for your own created algorithm. You can assess the success of your strategies and understand their strengths and weaknesses.You can view statistics of your strategy on Deployed page by simply clicking on “ 3 Small “dots beside’s name of your strategy.

This is how paper trading statistics of Tradetron looks like -

- 4. Window into Personal Trading Style: Tradetron's paper trading goes beyond practice; it acts as a powerful tool for self-discovery. It serves as a magnifying glass, helping you identify your trading strengths and weaknesses. By engaging in paper trading, you gain insights into your risk tolerance, patience levels, and how you react to market fluctuations. This process paves the way for crafting your unique trading style tailored to your personality and preferences.

- 2. Educational Value: For beginner traders, paper trading is an excellent educational tool. It helps traders understand trading principles, risk management, and the psychology of trading.

FAQ’S

Tradetron's paper trading is a feature that allows users to simulate their algorithmic trading strategies without risking real capital. It replicates real market conditions, enabling users to test their strategies, assess their performance, and make adjustments in a risk-free environment.

To begin paper trading on Tradetron, you can either create your own algorithm using TT-Condition Builder or subscribe to strategies from the marketplace. Afterward, deploy your chosen strategy by selecting a multiplier, execution type, and broker. For paper trading, choose "Paper Trading" as the execution type.

The "Multiplier" option in Tradetron allows you to adjust the trading size. For example, if you select a 2x multiplier while deploying a strategy, it will double the lot size used in your paper trading simulation.

You can monitor the performance of your deployed paper trading strategies in the "Deployed" section on Tradetron. You'll find open positions, notification logs, and various options to pause or exit your strategies directly from this page. Additionally, you can assess the entry and exit criteria of your strategies for fine-tuning.

Yes, there is a cost associated with Tradetron paper trading. Tradetron provides real-time paper trading of your algorithmic strategies at a rate of 15 Rs per day per deployment.

You can paper trade a variety of instruments on Tradetron, including stocks, options, and commodities. This versatility allows you to test your algorithmic strategies across different asset classes.

While it's technically possible to skip paper trading and start real trading directly on Tradetron, we strongly recommend against it. Real trading can be volatile and complex, and it involves financial risk. Paper trading is a crucial step that helps you understand the platform, refine your strategies, and build confidence before risking real capital. It's a safer and more educational approach to algorithmic trading.