Contents

Learning how to trade stocks of public companies in the equity markets can help you become financially independent. Great, but where and how do you start?

It all depends on the trading method of your preference and your overall investment goals. One of the disadvantages of traditional trading methods is that they are always subject to the effects of human emotions. Algorithmic trading represents a systematic approach that discards fickle, emotion-driven trading decisions in favor of data-driven choices.

Introduction to algo trading

Algorithmic trading or algo trading is a stock trading method that has been gaining rapid popularity over the last couple of decades. As the term suggests, it is a perfect blend of age-old stock investment practices and advanced computer algorithms. But how can computer algorithms help you trade stocks? Let’s find out.

What is algo trading?

Algo trading is the process of trading stocks using automated computer algorithms. It involves the use of highly intelligent computer programs that employ predefined mathematical logic to automatically place orders on the open market. The algorithm that controls trade decisions here usually considers several variables like historical trends, time, stock price, and stock quantity. Traders can use these factors to set up elaborate triggers that prompt the program to buy or sell stock. Let’s understand this better with the help of a few examples.

In a time-based trigger, an algo trading program is simply prompted to sell stocks after a few days or weeks of purchase.

In a price-based trigger, stocks of a given company are sold immediately when they fall below a certain market price.

A quantity-based trigger repurchases shares from a particular company if they fall below a set volume.

Most trading algorithms use complex mathematical arrangements of these conditions to ensure efficient trading. In theory, at least, a computer algorithm can be trained to make the best, most well-calculated trading decisions, helping investors generate profits faster than any human trader. However, keep in mind that the Securities and Exchange Board of India (SEBI) currently requires some degree of manual intervention before trade orders prompted by algorithmic systems can be placed in Indian markets.

A brief history of algo trading

While it may seem like a relatively modern invention, the history of algo trading dates back to the 1970s, when computerized trading systems were first introduced in American markets. These early systems allowed large companies and investment funds to discover a new, faster method of trading that relied on preset mathematical equations. By 1976, the New York Stock Exchange had adopted algorithmic trading in some forms, but it was still restricted to big trading companies.

In the decades following, financial journalist and author Micheal Lewis started advocating the use of algo trading by common, everyday traders. He deemed that the overly complicated structure of algo trading and lack of educational resources kept the common people from using the technique to their advantage. By the 1990s, smaller investment funds gained access to state-of-the-art algo trading machinery that opened up new avenues for them. The rise of highly accessible and user-friendly computer systems made algorithmic trading further accessible for everyday traders over the next few decades.

Prerequisites for getting started in algo trading

While algo trading has now become an easy option for non-technical and retail investors, there are a few skills and concepts you need to be familiar with to better understand the basics of the system.

Knowledge of programming languages

In algo trading, traders use complex computer algorithms to tell a computer program when and how it should execute a trade. These algorithms are fed to the program through coding or programming languages, which form the basis of communication between human beings and computers.

An easier way to understand programming languages is by thinking of them as languages that computers understand. While we can communicate ideas using English, our language needs to be translated in a way that computers can understand. Having a working knowledge of programming languages like C++, Matlab, Python, or Java can help you easily write and understand algo trading programs. While this might seem daunting at first, most of these languages use easy-to-understand rules and syntaxes that you can grasp with some practice!

Understanding of financial markets and trading

Knowing how financial markets operate and how you can place trades is, of course, fundamental to understanding algo trading. While your computer algorithms can help you automate the execution of trade orders, you still need to define the logic they work on. This means setting up appropriate triggers and knowing when is the right time to buy or sell shares.

A working knowledge of stock trading also requires you to have some insight into global financial trends. For instance, knowing how equity markets react to inflation can help you preempt price changes and set up your trading algorithms accordingly. Your goal should be to gain practical trading knowledge to help you make well-informed decisions.

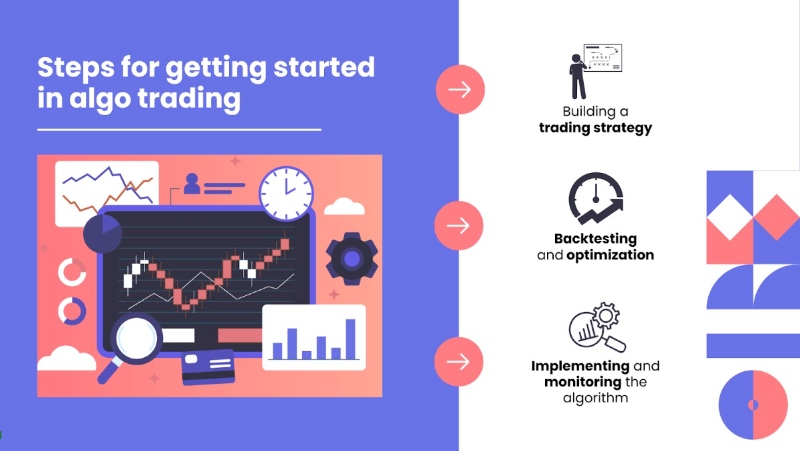

Steps for getting started in algo trading

Once you have the prerequisites in order, it is time to set up trading algorithms that can help you make profitable trades quickly and efficiently.

Building a trading strategy

Your first step should be to build an algo trading strategy that aligns with your trading goals and philosophies. You can either choose to diversify your portfolio by buying stocks of different companies or manage investment risks by buying and short-selling in set volumes. Your trading strategy is what ultimately guides your trading algorithm.

Backtesting and optimization

It is unlikely that you will stumble across the perfect trading strategy right at the beginning. Trading strategies usually need to be tested and optimized over time to make them better. Backtesting involves using historical data to check whether your strategy can help you get the right results. It helps you cross-check your trading strategies for mistakes or discrepancies that can steer you toward the wrong trades.

Implementing and monitoring the algorithm

Once you’ve tested and streamlined your trading strategy, it is time to translate it to mathematical algorithms that can be fed to your algorithmic trading program. You can use a series of mathematical and logical functions like ‘If’, ‘If else’, ‘While’, and ‘Switch Cases’ to account for different scenarios within your strategy. For example, the ‘If’ function allows your trading program to make conditional decisions based on parameters like time, trading volume, and share price. While the process is largely automated, it is important that you closely monitor your algo trading software while it executes trades for you. This can help you spot and fix errors as soon as possible and avoid taking on any major losses.

The future of algorithmic trading

Becoming familiar with algorithmic training is essential for new-age traders. As things stand, algo trading is actively revolutionizing global finance and equity markets. Amateur traders can now simply turn to low or no-code algo trading programs to place trade orders at an unprecedented speed and efficiency. By allowing people to invest faster and more frequently, algo trading increases liquidity in global markets. Harnessing the full potential of algo trading can help everyday investors like you make intelligent investments and become a part of this growth.

Start your algo trading journey with Tradetron

At Tradetron, we work to make algo trading more accessible to every investor. Our state-of-the-art patent-pending platform allows users to use simple visual elements to create elaborate algo trading models that they’re free to test and deploy any time. The best part of our solution is that it is completely coding-free, which means you need no prior coding experience to start building sophisticated trading models.

Visit our page to know more about who we are and how we can get you started with high-level algorithmic trading.

Made with Superblog

Made with Superblog