In the fast-moving world of trading, every decision you make can directly impact your profits or losses. While market conditions are unpredictable, your strategy doesn't have to be. One of the most effective tools used by successful traders to reduce risk and increase accuracy is Backtesting. Whether you're a beginner or an experienced trader, understanding how to backtest trading strategies can help you avoid costly mistakes and fine-tune your approach before putting real money on the line.

In this blog, we’ll explore what backtesting is, why it’s important, how to do it effectively, and how Tradetron makes the process easier than ever.

What is Backtesting in Trading?

Backtesting is the process of testing a trading strategy or algorithm on historical market data to evaluate its performance. The idea is simple—if a strategy worked well in the past under certain market conditions, it might have a good chance of working in the future under similar conditions.

When you backtest a strategy, you simulate how it would have performed using real historical price data, taking into account entries, exits, stop losses, take profits, and more. This helps you assess its effectiveness, profitability, and risk level—before risking real money in the live market.

Why Backtesting is Crucial in Trading

Avoid Trial-and-Error Losses

Without backtesting, you’re essentially gambling. Backtesting helps you validate your strategy before you deploy it in live conditions.Performance Analysis

You can analyze key metrics like win rate, average return, drawdown, Sharpe ratio, etc., and improve your decision-making.Emotional Detachment

When you trust your backtested data, you rely less on emotions and more on logic during real trades.Optimizing Strategy Parameters

Backtesting helps you fine-tune the settings of your strategy like stop loss, target, timeframes, and indicators.Build Confidence

Knowing your strategy has performed well historically builds confidence and discipline in your trading journey.

How to Backtest a Trading Strategy

Here’s a simplified step-by-step process:

Define Your Strategy Clearly

Set clear rules for entry, exit, stop loss, target, position size, etc.Choose Your Market & Timeframe

Decide whether you are testing on equities, crypto, forex or commodities—and select relevant timeframes.Select Historical Data

Choose reliable and clean historical price data that matches your target asset and timeframe.Run the Simulation

Apply your rules on historical data and simulate trades.Analyze Results

Review your profit/loss ratio, drawdowns, number of trades, max loss per day/week, etc.Adjust and Re-test

Tweak your strategy parameters if needed and run the backtest again to improve performance.

Why Tradetron is a Game-Changer for Backtesting

Backtesting manually can be time-consuming and prone to errors. With Tradetron, you get a no-code, automated platform where you can:

Create custom trading strategies

Backtest them instantly on historical data

View detailed performance metrics

Optimize and iterate effortlessly

Go live only when you’re confident in your strategy

Tradetron's powerful backtesting engine helps reduce the guesswork and brings data-driven precision to your trading approach.

Whether you're backtesting a simple moving average crossover or a complex multi-leg options strategy—Tradetron makes it effortless and reliable.

Step-by-Step Process to Perform Effective Backtesting

To make your trading strategies more accurate and data-driven, here’s a clear step-by-step process that shows how you can create and perform a backtest efficiently. Follow these practical steps to build confidence in your strategy before going live in the market.

Here the process of Tradetron Backtest-

1. Create strategy.

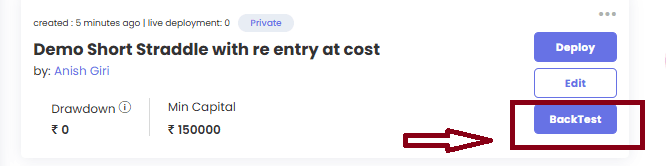

2. Once strategy created back to my strategy page and select backtest

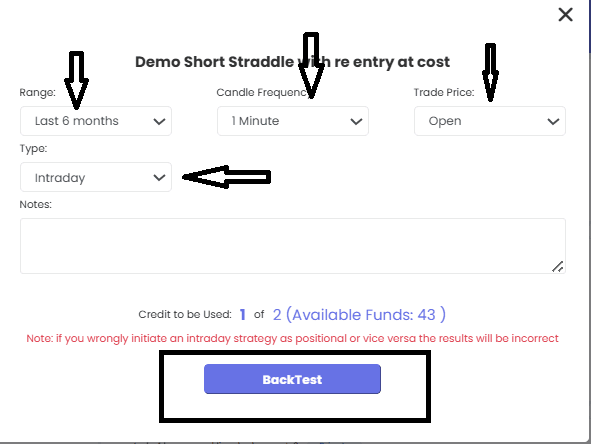

3. Select all parameters according to your strategy setup and click on backtest

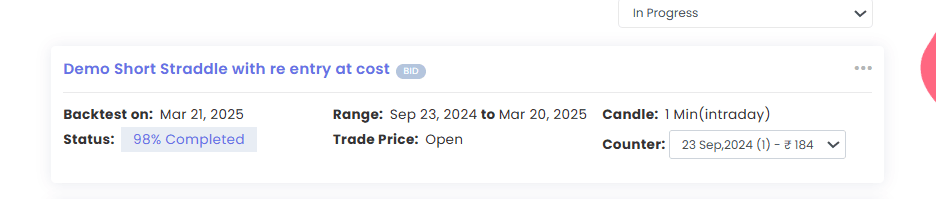

4. Now goto backtest page and check In progress section .

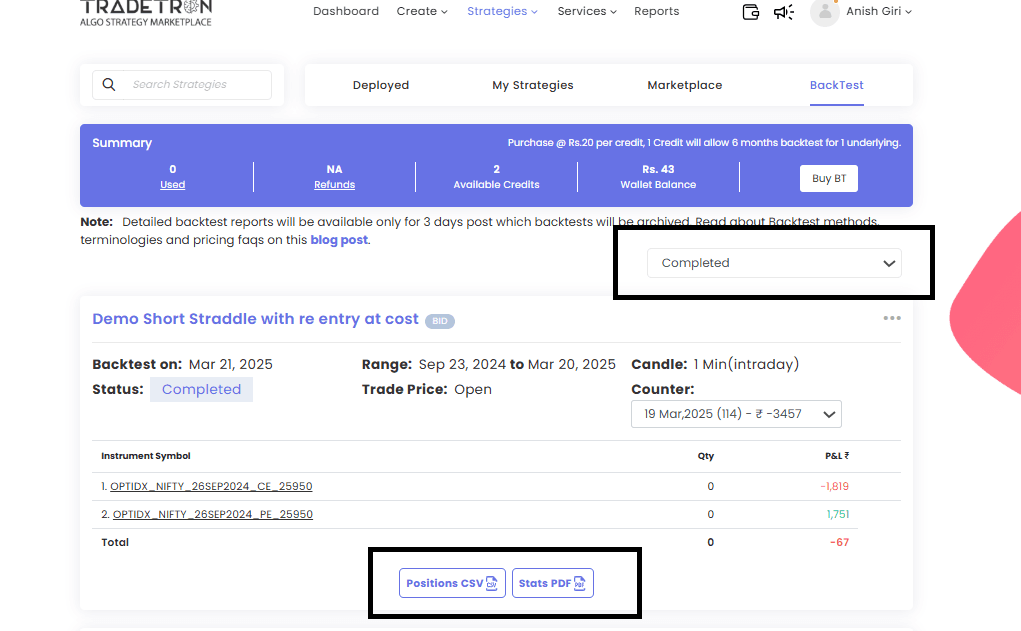

5. Once Backtest Completed shift to completed and review your backtest.

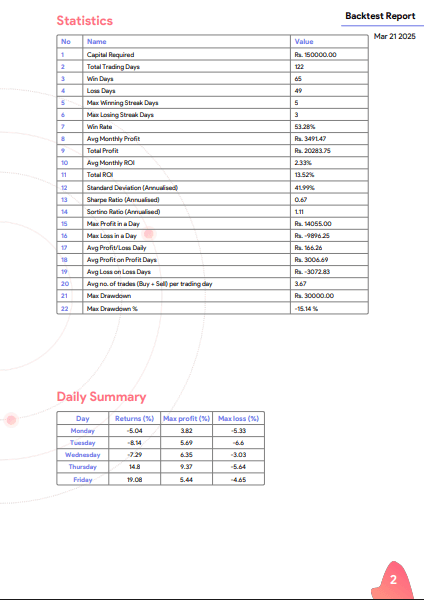

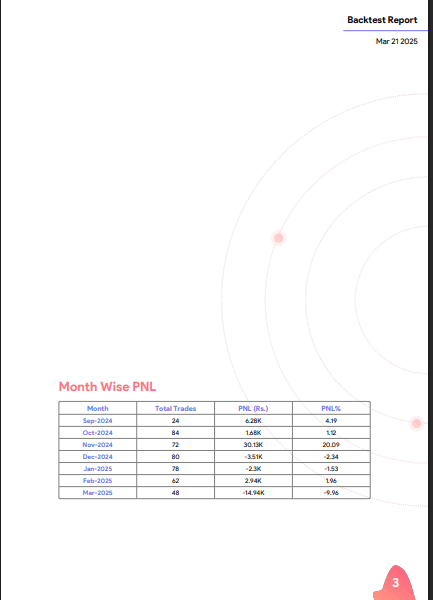

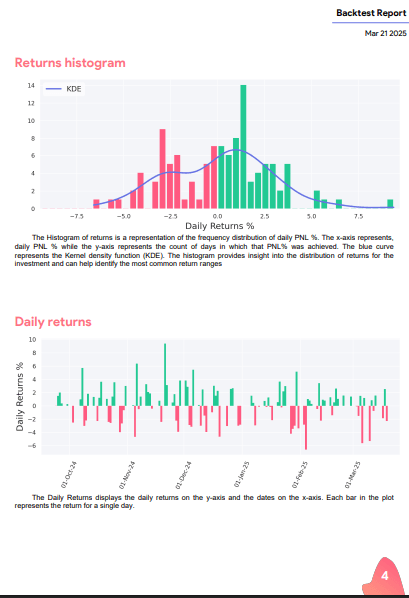

Here a Sample backtest reports -

Conclusion

Backtesting is not a luxury—it’s a necessity for smart trading. In a market where even a small mistake can lead to major losses, backtesting helps you stay prepared and ahead. It enables you to design strategies backed by data, not just instincts.

And with Tradetron, backtesting becomes easy, fast, and effective—so you can trade confidently and smartly.

If you’re serious about avoiding costly mistakes and making informed trading decisions, start backtesting today. Because smart traders don’t just predict the market—they prepare for it.

FAQs – Backtest Trading

Q1. Can I trust backtesting results completely?

Backtesting is a powerful tool, but it’s not foolproof. It works best when used with quality data and realistic trading assumptions. Live markets can still behave unpredictably.

Q2. How much historical data is enough for backtesting?

Ideally, use at least 1–2 years of data, or longer for strategies that depend on macro trends. The more data you test on, the better your insights.

Q3. Can beginners do backtesting?

Absolutely! Platforms like Tradetron allow even beginners to create and test strategies without coding or technical knowledge.

Q4. What if my strategy performs well in backtesting but fails in live trading?

> This can happen due to overfitting, slippage, or different market conditions. It’s important to test in real-time (paper trading) after backtesting.

Q5. Is backtesting available for crypto strategies on Tradetron?

Yes, Tradetron supports backtesting for both crypto and equity markets—making it a perfect solution for diversified traders.

Made with Superblog

Made with Superblog