Contents

In the ever-evolving landscape of financial markets, traders seek innovative strategies to optimize returns. Today, we delve into the intriguing realm of ratio spreads and how Tradetron's Option Wizard can be harnessed to craft a robust non-directional intraday strategy. Join us on this journey as we explore the nuances of ratio spreads, dissect the strategy-building process, and unravel the insights gained from historical backtesting.

Understanding Ratio Spreads

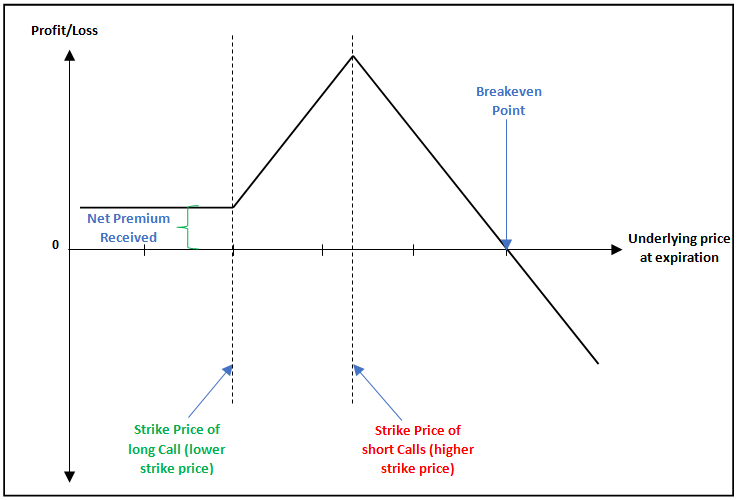

Ratio spreads, as the name suggests, involve the strategic use of a particular spread. A spread, in essence, consists of buying and selling options within a call or put. Visualize a scenario where an ATM (At-The-Money) put with a strike of 21,500 is bought and simultaneously, an OTM (Out-of-The-Money) put with a strike of 21,100 is sold. This creates a spread. Altering the quantity of the sell option introduces the concept of a ratio spread. The resulting graph depicts a distinctive pattern, resembling a Batman figure. The long strike can be either in-the-money, at-the-money, or have a comparatively higher premium compared, with the short strike having a higher quantity.

Building a Strategy with Tradetron's Option Wizard

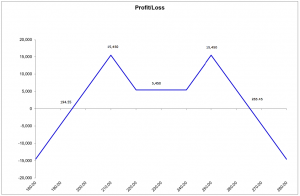

This strategy, although not original, offers a structured approach to intraday trading. The process commences daily at 10:00 AM, where call and put strikes, both ATM, are bought. Subsequently, OTM 3 calls and puts are sold, each with triple the quantity of the buy legs. The resulting payoff graph showcases a central point with a low non-directional profit, flanked by two selling points, culminating in a break-even line. This characteristic visual resemblance to a Batman figure has earned it the moniker of the Batman strategy.

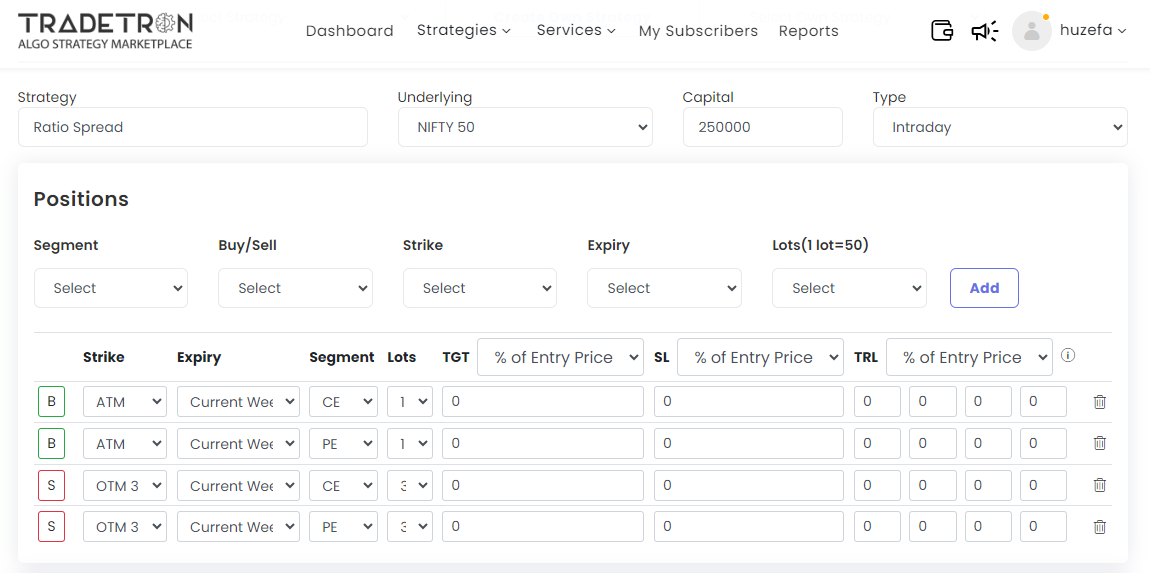

Creating the Strategy on Tradetron

Utilizing Tradetron's Option Wizard, traders can seamlessly implement this strategy. Start by creating a custom strategy named 'Ratio.' Specify the underlying asset (Nifty, in this case) and set the capital at 2.5 lakhs. Choose the intraday type and proceed to add the desired positions. The buying of ATM call and put legs, along with selling OTM 3 call and put legs, is meticulously orchestrated. Setting the entry time at 10:00 AM and incorporating a trailing stop-loss mechanism further enhances the strategy's sophistication.

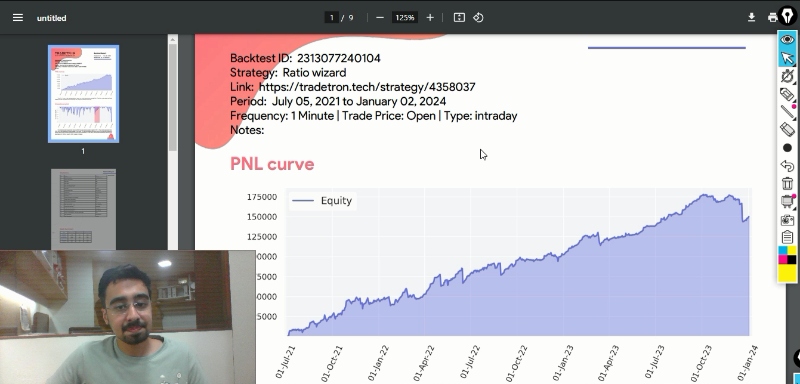

Backtesting for Insightful Analysis

The real litmus test for any strategy lies in historical performance. Tradetron facilitates this crucial step through its backtesting feature. By assessing the steadily rising P&L curve, traders gain insights into the strategy's efficacy. The maximum drawdown and recovery periods from losses provide valuable metrics for risk assessment. In this case, the strategy showcases an 8% maximum drawdown, with an 84-day recovery period.

Key Takeaways from Backtest Analysis

Optimizing Performance:

Mondays exhibit an average negative return of 7%, hinting at potential optimization by excluding Mondays from trading activities.

Monthly Performance Reports:

The month-wise P&L report aids in understanding trade frequency, essential for factoring in trading costs and other expenses associated with system-based trading.

Return Histogram Analysis:

The return histogram reveals the distribution of daily returns. A notable positive aspect is the dominance of gaining returns, showcasing the strategy's inherent strength.

Conclusion:

Empowering Traders with Insights

In the dynamic world of trading, strategies are a trader's arsenal. The Ratio Spread Strategy, crafted using Tradetron's Option Wizard, exemplifies a systematic and well-defined approach to intraday trading. Backtesting serves as a powerful tool, offering traders a glimpse into historical performance, enabling data-driven decisions.

As you tread your trading journey, consider exploring the Ratio Spread Strategy. May your financial endeavors be guided by insightful analysis, strategic precision, and a profitable outcome.

For traders seeking continuous learning and improvement, feel free to share your strategies or suggest topics for future discussions in the comments. Together, we navigate the intricate landscape of financial markets. Thank you for reading, Happy Trading!

Made with Superblog

Made with Superblog