Contents

- Introduction:

- Inspiration from Social Media Buzz:

- Initial Strategy: Long Straddle for Market Dynamics

- Setting the Stage: Conditions for Execution

- Implementing a Trailing Stop Loss

- Optimizing with Trailing Stop Loss Values

- Refining Entry Conditions

- Comparative Performance Analysis

- Conclusion: The Art of Continuous Improvement

Introduction:

In the fast-paced world of financial markets, the ability to convert market insights into actionable strategies is a skill that sets successful traders apart. This blog explores the intricate process of transforming raw ideas into robust trading strategies, refining them based on real-world results. Join us on a journey where we decode the art of strategy conversion and optimization, focusing on a recent inspiration derived from social media buzz.

Inspiration from Social Media Buzz:

The spark for this exploration ignited from the cacophony on social media surrounding a 50-rupee option premium hitting 920 on the expiry day. The thought process unfolded: what if one could leverage this situation by employing a simple strategy like a long straddle? The foundation was laid, and it was time to delve into the mechanics of this intriguing concept.

Initial Strategy: Long Straddle for Market Dynamics

The core idea involved constructing a straightforward long straddle using a 50-rupee option premium. The premise was to create a position that could benefit from significant market movements, especially during unexpected fluctuations. In this strategy, both a call and a put option were purchased, and the approach was to hold onto the position, incorporating predefined targets and stop-loss parameters.

Setting the Stage: Conditions for Execution

Executing this strategy required a set of conditions to identify opportune moments. The focus was on situations where the combined premium of the call and put options was less than 50 rupees. This marked the entry point for the trade, providing a structured approach to navigating the complexities of the market.

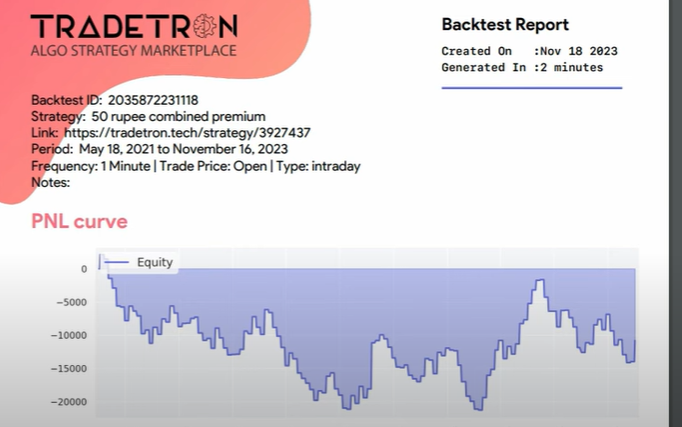

Backtesting Journey Begins:

With the initial strategy outlined, the next crucial step was backtesting. Thirty months of historical data were employed to understand the performance of the strategy over time. However, the results revealed a less-than-ideal scenario – the equity curve meandered, neither soaring in profits nor plummeting in losses.

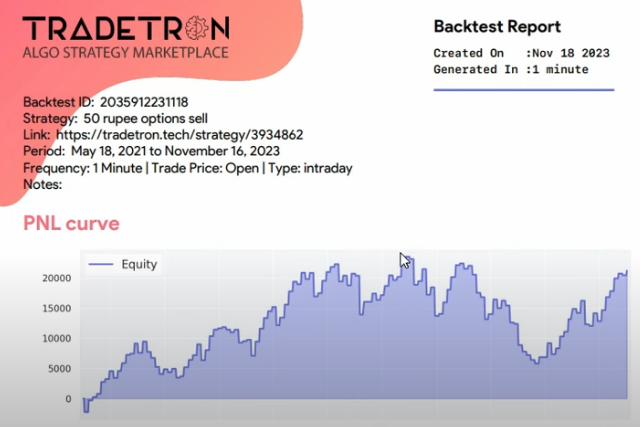

Transition to Selling Strategy:

In the quest for improvement, a pivotal decision was made to shift from buying options to selling them. This alteration aimed to reverse the downward trend in the equity curve. The strategy now centered around selling a 50-rupee premium option and holding onto it to capture potential gains.

Implementing a Trailing Stop Loss:

Recognizing the importance of risk management, a trailing stop-loss mechanism was introduced. This addition aimed to safeguard profits and limit losses. The strategy now dynamically adjusted to the intraday market movements, ensuring a disciplined exit when necessary.

Optimizing with Trailing Stop Loss Values:

Optimization became the key focus. Different trailing stop-loss values were tested to identify the sweet spot that would enhance the strategy's performance. The results showed promising improvements, validating the significance of this dynamic risk management approach.

Refining Entry Conditions:

Further refinement was deemed necessary. Additional entry conditions were introduced to filter out less favorable scenarios. The strategy was now programmed to execute trades only before 3:25 PM and when the combined premium of call and put options was within a specified range.

Comparative Performance Analysis:

A meticulous comparison between the strategy with entry condition restrictions and the unrestricted version provided insights into the evolution of performance. The refined strategy showcased slightly more profitable days over the 30-month period, reinforcing the importance of adaptability.

Conclusion: The Art of Continuous Improvement

In conclusion, crafting successful trading strategies is not a one-size-fits-all endeavor. It requires continuous improvement, adaptation, and a keen understanding of market dynamics. This journey showcased the iterative process of strategy building, emphasizing the need for dynamic adjustments to thrive in the ever-evolving world of financial markets.

Strategy link: https://tradetron.tech/strategy/3934947

Made with Superblog

Made with Superblog