All About Marketplace Settings On Tradetron - A Detailed Guide

Before we understand Marketplace Settings, we need to understand, what is a Marketplace on Tradetron.

Similar to how Amazon, eBay & Alibaba.com are e-commerce marketplace for products, Tradetron is a marketplace for algo strategies.

What do you mean by this?

Similar to how vendors can sell products on Tradetron, users can create strategies and put them up on the marketplace for others to subscribe and use.

Tradetron Marketplace

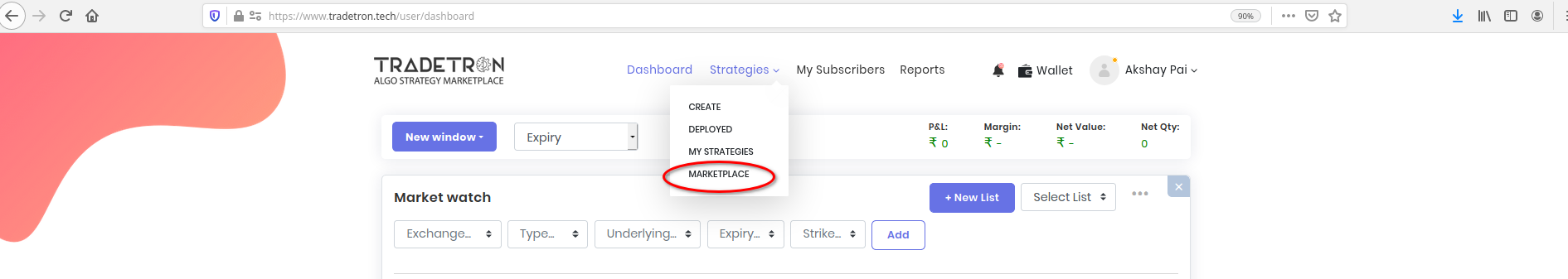

To go to TradeTron Marketplace, go to Strategies -> Marketplace.

Check this Video:

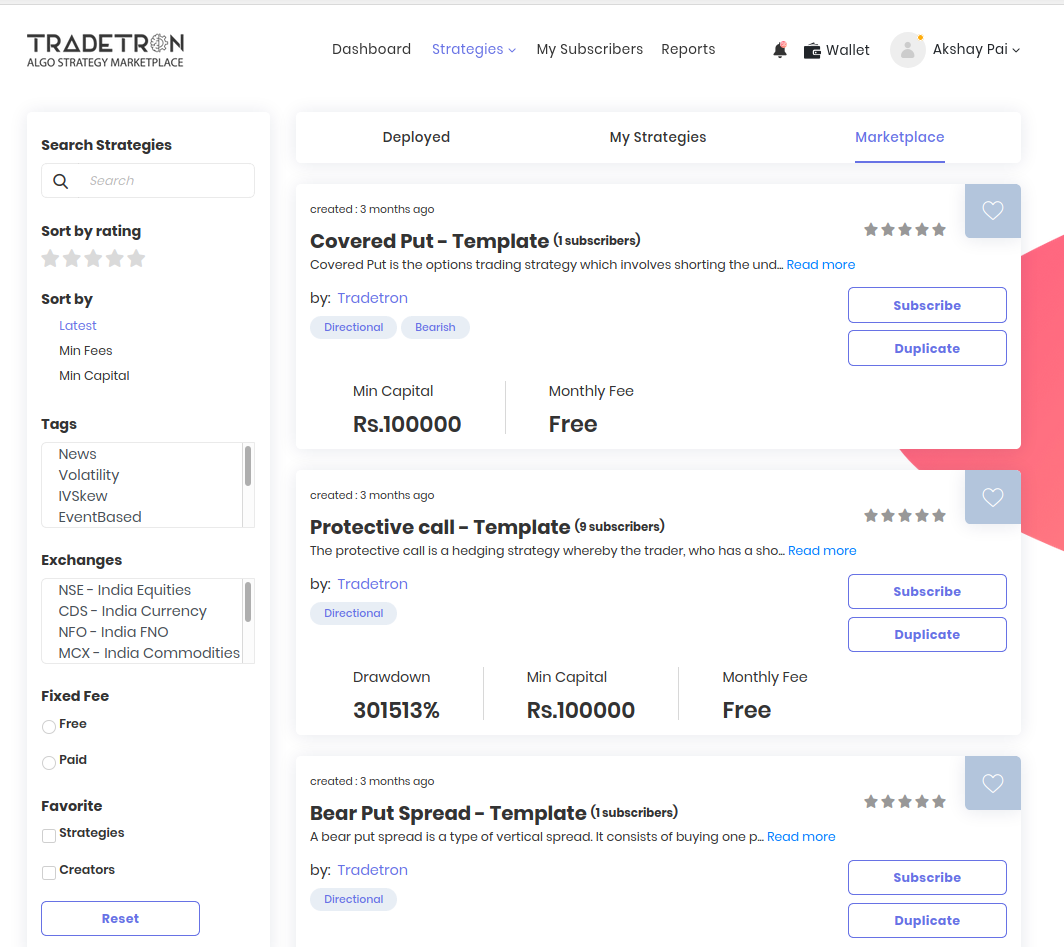

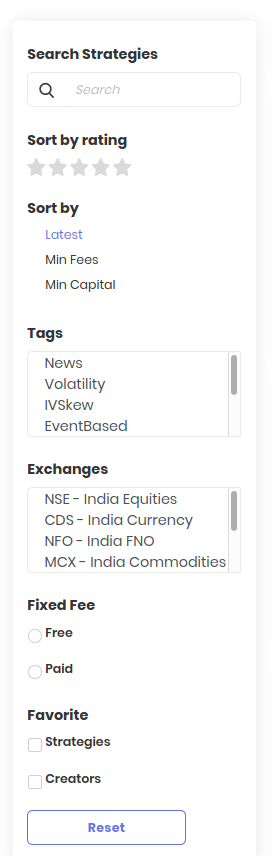

The Left side of this page is where you search, sort or filter strategies.

The right side is where all the strategies are listed that exist on Tradetron.

Note: New strategies are added frequently, be on the lookout.

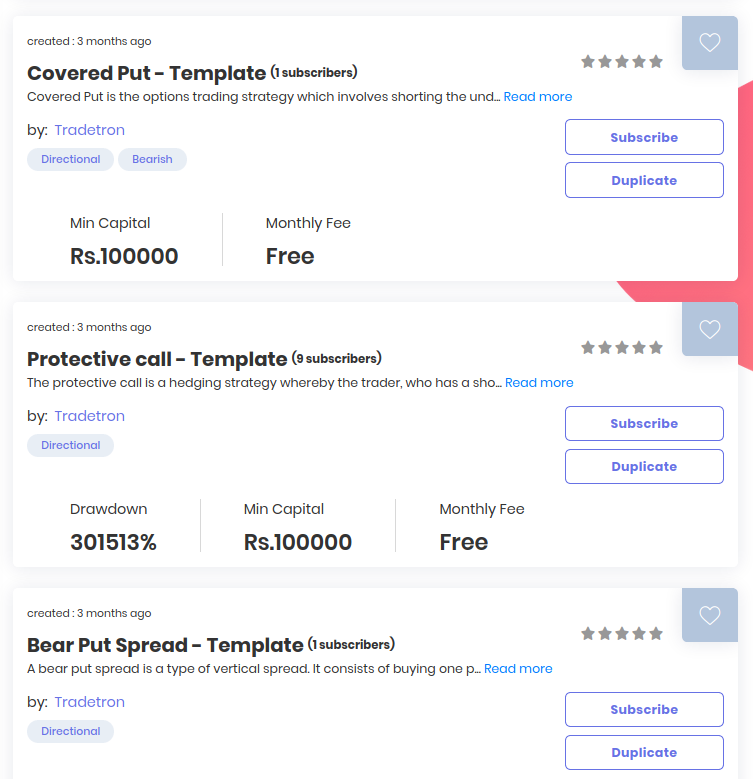

Click the name of any strategy and you will be redirected to the strategy details page.

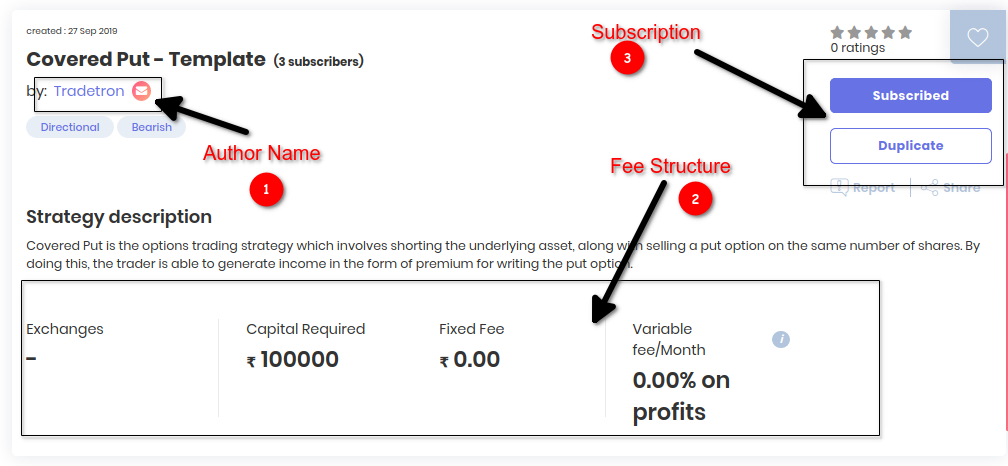

The strategy page is divided into four sections,

- Description

- Subscribers

- Statistics

- Rating & Feedback

These parameter become very useful for a user to evaluate the strategy, Hence, let us understand them one by one.

Section 1:

Description: This is the first block, it has the description about the strategy and the author name.

Note:

You can click on the author name to see his/her profile and other strategies created.

- This block will also tell a user, what the fee structure is for this strategy.

- More importantly, here, in this block, you will get the option to subscribe to this strategy or duplicate it.

Note:

1. Subscribing & duplicating a strategy are two different actions.

Subscribing to a strategy only lets a user runt it from his account, it will not allow the user to see it mechanics or modify it.

Duplicating a strategy however, lets the user create an instant of the said in their account.

Duplicating gives the user complete control over the algorithm & modification rights in their instance.

2. The option to let a user choose Duplicating or Subscribing is controlled by the author.

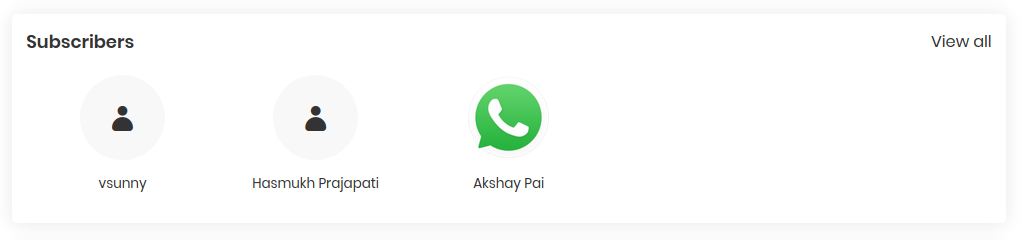

Section 2:

Subscribers: If the strategy author chooses, a new user can view all other subscribers to the strategy.

Note:

You can also click on each subscriber and check his/her profile.

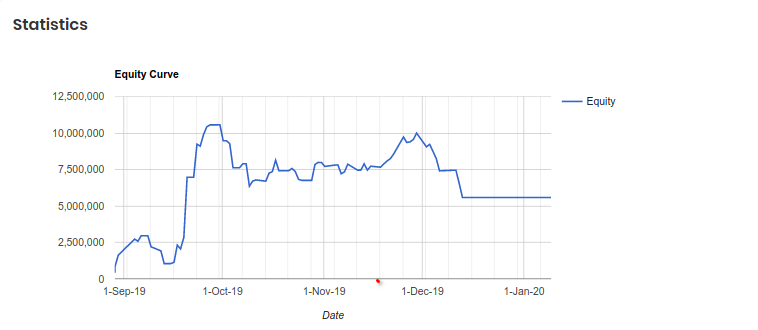

Section 3:

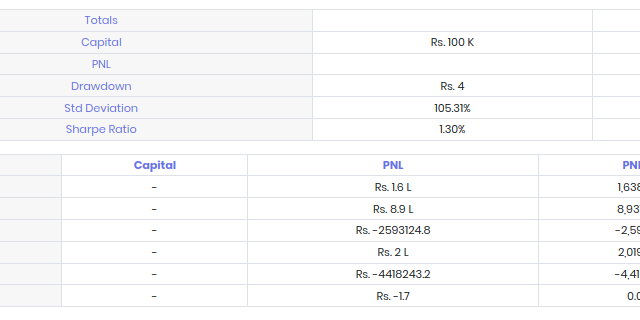

Statistics: As the name suggests, this block gives you a detailed information about how the strategy has performed.

Section 4:

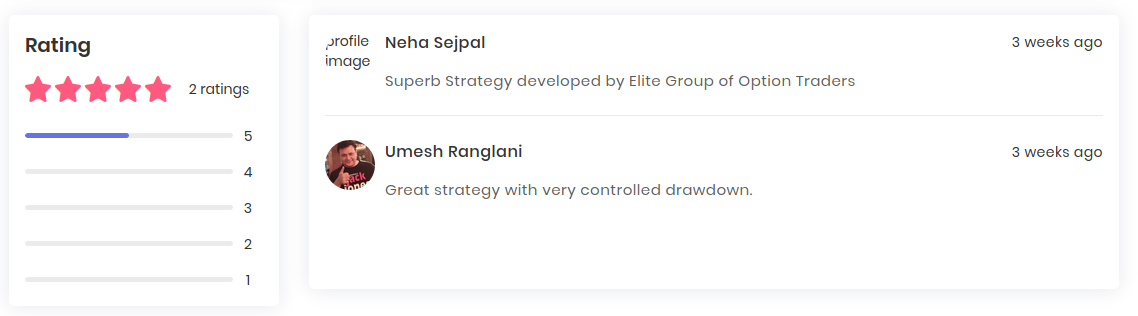

Ratings/Feedback: You can rate a strategy and give your feedback.

Note:

You can only give ratings and feedback to strategies that you have subscribed to.

Once you have subscribed to a strategy, it will be listed in your "My Strategies" page.

So how are these access controls set by the author?

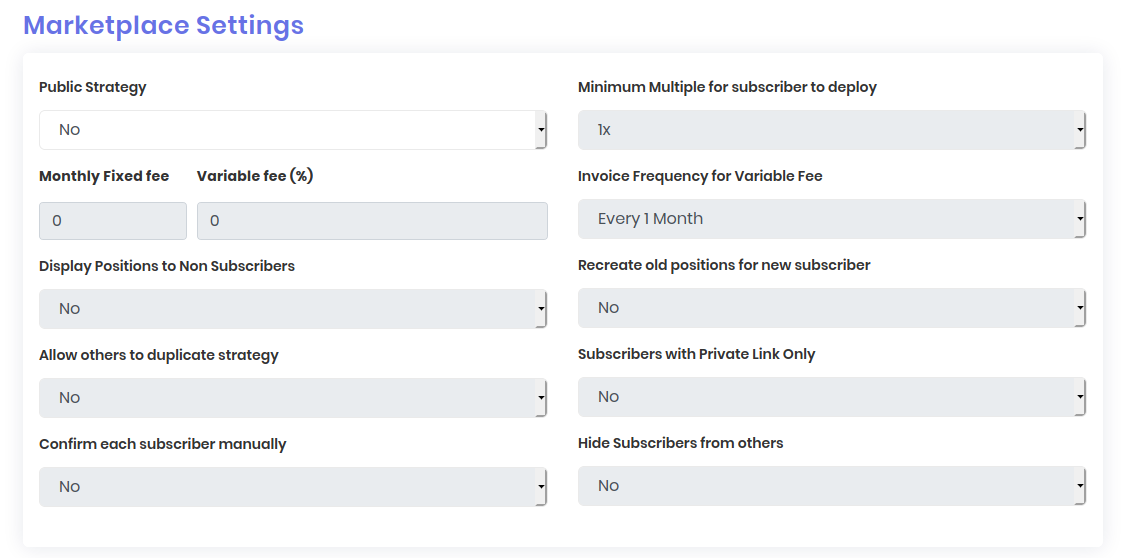

While creating the strategy itself, Tradetron, gives the author, all the parameters to control the access in the Marketplace Settings section.

Let us understand each parameter.

Note:

If a user duplicates a strategy and modify it in their account, the changes are only limited to their account.

The original strategy will retain its setting and parameters.

Note:

If a user duplicates a strategy and modify it in their account, the changes are only limited to their account.

The original strategy will retain its setting and parameters.

- Public Strategy: This parameter allows the author to decide if they wants to list the strategy on the Tradetron Marketplace.

- Monthly Fixed fee & Variable fee (%): Monthly fee is an absolute amount which the author claims from the user. The Variable fee is the percentage of the profit, the author claims from the user.

- Display Positions to Non Subscribers: This Parameter if set to Yes, will allow non-subscribers to see the positions taken by the strategy.

- Allow others to duplicate strategy: If set to Yes by the author, will allow the users to create an instance of the strategy in their account, there by giving them complete control to modify it in their own account.

- Confirm each subscriber manually: If set to Yes the author will have to authorize each subscriber request.

- Minimum Multiple for subscriber to deploy: The multiplier set in this parameter multiplies the position size set in the condition builder. The minimum set by the author will be default for all subscribers

- Invoice Frequency for Variable Fee: The frequency of the invoice sent by the author to the subscribers.

- Recreate old positions for new subscriber: This option if set to Yes will recreate all position previously taken by the strategy for a new subscriber

- Subscribers with Private Link Only: If the author chooses not to approve each subscriber manually, however, wishes to broadcast his private strategy to only his closed circle, the author can do so by using this parameter. If set to Yes the strategy stays public, however, not visible in the market. The author can then share the strategy link with users for subscription.

- Hide Subscribers from others: If set to Yes the author can hide his subscribers to new users.

Frequently Asked Questions On Tradetron

1. What is Tradetron Marketplace?

Tradetron is a revolutionary platform that allows users to create, test and deploy algorithmic trading strategies without any coding knowledge.

It provides an online marketplace for traders to buy and sell fully automated trading strategies or "algo bots".

The Tradetron Marketplace offers a wide variety of algo bots ranging from simple moving average crossovers to complex neural networks.

The platform also provides backtesting tools that allow users to see how their strategy would have performed in historical markets before deploying it in real-time.

Tradetron Marketplace is a one-stop-shop for all your algorithmic trading needs- providing easy-to-use automation tools while giving you access to a vast array of pre-built algo bots or creative opportunities through its marketplace.

2. What is a Trading Marketplace?

A trading marketplace is an online platform where buyers and sellers come together to exchange goods or services.

It allows individuals or businesses to buy and sell their products in a centralized location, creating a convenient and efficient way of conducting business transactions.

In a typical trading marketplace, users can create profiles, post listings for items they want to sell, set prices and negotiate with potential buyers.

The platform also offers tools such as payment processing systems, shipping options, dispute resolution mechanisms and other features that help facilitate the transaction process.

3. What is a Trading Platform?

A trading platform is a digital tool used by traders to buy and sell various financial instruments such as stocks, bonds, commodities and currencies.

It provides access to real-time market data, charts and analysis tools that enable traders to make informed decisions about their investments.

Trading platforms vary in design and functionality but they typically offer features such as order entry, stop loss orders, limit orders and margin trading.

They can also provide educational resources for new investors on how to use the platform effectively.

The aim of a trading platform is to provide traders with an easy-to-use interface that allows them to interact with different markets seamlessly.

This means that a trader can easily move between different types of assets without having to navigate through complex menus or interfaces.

If you have any questions please write us to [email protected].