Algorithmic trading has revolutionized the financial industry, rapidly emerging as a game-changer for investors and traders alike. With its ability to adapt to various market conditions, algorithmic trading has proven highly beneficial, especially for those who previously struggled with managing emotions and making decisions under pressure. By utilizing computer programs to make financial decisions, traders can leverage a diverse range of inputs and instructions to determine the optimal times to buy or sell. These algorithms closely monitor price charts, analyzing market trends and executing trades accordingly.

The impact of algorithmic trading on the market is substantial, with approximately 40% of market movements in the India is influenced by Computer programs trading on behalf of Humans and institutions. Moreover, large brokerage firms and institutional investors are anticipated to adopt algorithmic trading as a means to streamline operations and reduce expenses.

Thanks to technological advancements in the financial industry, algorithmic trading has become increasingly accessible to a wide range of traders. This trading method has gained popularity not only in the stock market but also in Commodities market. As accessibility improves, more individuals can leverage the benefits of algorithmic trading to enhance their investment strategies and capitalize on market opportunities.

In this blog post, we will explore the prerequisites of algorithmic trading with Python, discuss the difficulties of coding, and present the advantages of zero-coding platforms like Tradetron.

Prerequisites for Algorithmic Trading with Python:

1-Proficiency in Python:

To engage in algorithmic trading with Python, a solid understanding of the Python programming language is essential. Learning a programming language and understanding its nuances can be challenging, especially for traders with no prior coding experience. The learning curve can be steep. Coding algorithms in Python involves managing complex code structures, debugging, and maintaining codebases.

Additionally, keeping up with evolving market conditions and adjusting strategies requires continuous coding modifications.

Coding trading strategies in Python can be time-consuming, especially when dealing with complex algorithms or advanced trading techniques. Traders may need to invest considerable effort in backtesting and optimizing strategies before they can be deployed in live trading.

Further let’s take an simple example to understand above scenario In more efficient manner -

For this example we will developing a simple strategy , where it will take a trade at 9:20 on every Thursday and square it off if loss is more than 2000 Rs. And then we will repeat the strategy trade cycle after universal exit.

This is the dummy python code for the above strategy -

import datetime

import time

def check_time():

now = datetime.datetime.now()

if now.weekday() == 3 and now.hour == 9 and now.minute == 20:

return True

return False

def calculate_loss():

# Calculate the loss for the straddle position

# Insert your logic here to calculate the actual loss

loss = 2500 # Placeholder value for demonstration purposes

return loss

def square_off_position():

# Implement the square-off logic for the straddle position

# Insert your code here to square off the position

print("Position squared off")

# Main program loop

while True:

if check_time():

# Place the code for selling the ATM Nifty Bank straddle here

print("Straddle sold at 9:20 am every Thursday")

while True:

loss = calculate_loss()

if loss > 2000:

square_off_position()

break

else:

# Insert any additional logic or operations required while holding the position

time.sleep(60) # Sleep for 1 minute before checking the loss again

else:

time.sleep(60) # Sleep for 1 minute before checking the time again

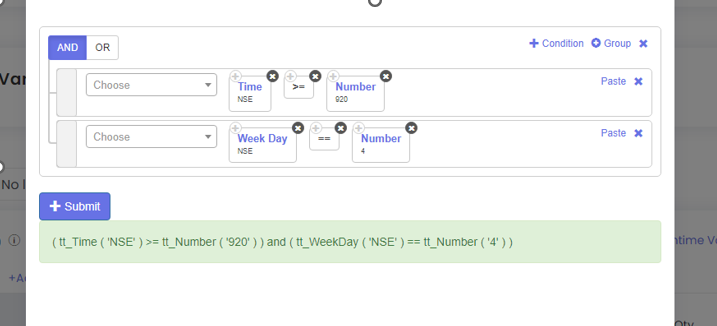

And for the same strategy this is the code block in Tradetron’s zero coding platform -

Where we just need to drag and drop keywords and you can even built a complex options trading strategies .

See, how simple it is to make a strategy in Zero – coding platform’s like Tradetron . Even you can backtest it and trust me its very simple to backtest strategies in Tradetron as compared to writing 40-50 line code in python. To know more about zero-coding algorithm trading please visit our website Sign up here

Now let’s further discuss the second requirement for algorithmic trading with python

2-Robust Infrastructure Requirements:

Implementing algorithmic trading with Python necessitates a robust infrastructure.

Consider the following aspects:

A)-Reliable Internet Connection: A stable and fast internet connection is crucial for real-time data retrieval, trade execution, and connectivity with trading platforms and data providers. If there is any connection breach then algo’s may go into error state as API connection is breached resulting into huge losses.

B)-Powerful Hardware: Algorithmic trading can require significant computational resources. Investing in a high-performance computer with ample processing power and memory capacity will ensure smooth execution and speed up backtesting and analysis processes.

When it comes to Zero coding platform like Tradetron all you need to pay is just 300 rs a month for deploying fully automatic strategy. You don’t need to worry about hardware as well as internet connection. Tradetron’s cloud servers will do their jobs respectively.

Recognizing the challenges of coding for algorithmic trading, zero-coding platforms like Tradetron have emerged as user-friendly alternatives. Yes, you can begin algorithmic trading without coding . These platforms offer intuitive interfaces, pre-built strategies on marketplaces , and automation capabilities without the need for coding expertise. Here are some advantages:

1-Accessibility to Non-Coders: Zero-coding platforms provide accessibility to traders without coding skills. These platforms offer user-friendly interfaces, enabling anyone to create, customize, and deploy trading strategies without the need for extensive programming knowledge.

2- Rapid Strategy Deployment: With zero-coding platforms, traders can quickly deploy their strategies in live trading. The intuitive interfaces and pre-built modules allow for efficient strategy implementation, reducing the time required to go from idea to execution.

3-Integration and Automation: Zero-coding platforms seamlessly integrate with data providers, execution providers, and other tools. Traders can access real-time data, automate trade executions, and streamline their trading workflow, leading to increased efficiency and improved decision-making.Like in Tradetron you can connect tradingview api with tradetron in order to automate signal trading. Here’s how you can do the same -

Trading Automation with TradingView and Tradetron | TT Uni

Join the course Now!!!.

4-Simplicity and User Experience: Zero-coding platforms prioritize simplicity and user experience, making them accessible to traders of all skill levels. The intuitive interfaces and drag-and-drop functionalities allow for a smooth trading experience, reducing the barriers to entry for algorithmic trading.

5- Strategy Marketplace and Collaboration: Some zero-coding platforms offer strategy marketplaces where traders can share and collaborate on strategies. This fosters a community-driven approach, enabling traders to learn from each other, gain insights, and explore diverse trading strategies.

Tradetron's zero-code approach makes algo trading accessible to all traders, regardless of their coding proficiency. Whether you are a beginner or an experienced trader looking to automate your strategies, Tradetron provides a comprehensive platform that empowers you to begin algo trading without the need for coding. Start exploring Tradetron today and unlock the benefits of automated trading in the Indian markets.

Conclusion-While algorithmic trading with Python provides flexibility and customization options, it requires coding skills, involves complexity, and demands a robust infrastructure. In contrast, zero-coding platforms offer accessibility, ease of use, rapid deployment, and integration capabilities. These platforms simplify the process for traders without coding expertise, enabling them to leverage pre-built strategies, automate trade executions, and participate in the algorithmic trading revolution with ease.

#algotrading

Read our latest blog

Made with Superblog

Made with Superblog